How to Maximize Your 401(k) Employer Match

7 min read

7 min read

When it comes to building long-term financial security, few opportunities have the same potential as your employer’s retirement plan match. Whether you’re just starting your career, navigating mid-career decisions, or managing a high-income strategy, understanding how to maximize your 401(k) employer match can be a critical key to retirement planning.

Why a 401(k) employer match matters

Employer matching contributions are essentially free money added to your retirement savings. Employer matches are most commonly offered through 401(k) plans and are based on a percentage of your salary and your own contributions. For example, a typical match might be 50% of your contributions up to 6% of your salary. Read more about matching contributions from the IRS.

Failing to contribute enough to receive the full match is like leaving part of your paycheck on the table. Matching contributions have the potential to increase your retirement savings over time. Why? Because of the power of compounding interest.

How compounding interest works for you

Compound interest is the engine behind long-term retirement growth. When you contribute regularly—and receive matching funds—your money earns interest, and that interest earns interest.

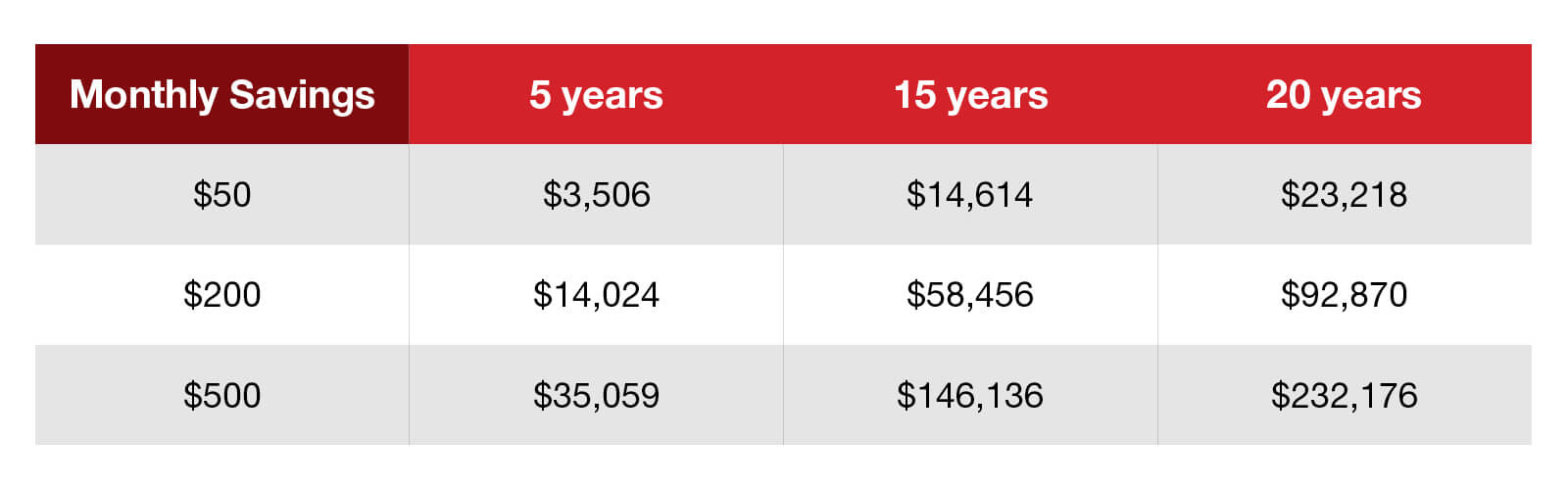

Here’s a simplified example from the IRS:

These figures assume a 6% annual return on your initial investment. You can explore your own potential growth using the Ameritas retirement savings calculator. This is a hypothetical example for illustrative purposes only. Actual results may vary.

Investment basics: Terms to know

Before diving into your specific retirement plan paperwork, it’s helpful to understand a few key investment terms that can guide your decisions and help you make the most of your employer-sponsored benefits. Check our retirement plans glossary for more terms.

- 401(k): A retirement savings plan offered by employers that allows employees to contribute a portion of their paycheck before taxes, with potential employer matching and tax-deferred growth.

- Roth 401(k): An employer-sponsored retirement savings plan where employees contribute with money they’ve already paid taxes on, making the contributions and any qualified earnings withdrawals tax-free in retirement.

- Vesting: The process by which an employee earns the right to keep employer-contributed funds in a retirement plan, usually based on years of service.

- Asset allocation: The process of dividing investments among different asset categories, such as stocks, bonds, and cash, to balance risk and reward.

- Risk tolerance: Your comfort level with market fluctuations and potential losses, which helps guide your investment choices.

How can you make the most of your 401(k) employer match at every stage of your professional journey? These tips will help set you up for success.

Newly hired? Start strong, build early

Beginning a new job often comes with a flood of onboarding paperwork, and retirement plan enrollment can easily be overlooked. But this is the moment to set a strong foundation.

Key tips for new employees:

- Enroll immediately: Don’t wait. Some employers offer automatic enrollment, but others require you to opt in.

- Contribute enough to get the full match: If your employer matches up to 6%, aim to contribute at least that amount.

- Understand vesting schedules: Some employers require you to stay for a certain period before you fully own the match. Know your plan’s rules.

Even small contributions can grow substantially over time. For example, contributing just 1% more each year can lead to additional savings. Read our blog to learn more about retirement saving strategies.

For mid-career professionals: Reassess and optimize

Mid-career is a great time to reevaluate your retirement strategy. You may have increased earnings, changed employers or accumulated multiple retirement accounts.

Strategies to consider:

- Increase contributions: Whenever you can, increase your contributions up to the maximum amount.

- Take advantage of catch-up contributions: If you’re age 50 or older, you may be eligible to contribute extra to your retirement plan.

- Consolidate accounts: If you do find yourself with multiple 401(k) accounts, carefully consider your options to simplify management and ensure you’re not missing out on matches. You can leave your old accounts with your previous employer, cash them out (tax penalties may apply), roll them over to your new employer’s plan or roll them over to an IRA.

Also, review your investment allocations and consider diversifying to align with your risk tolerance and retirement timeline.

Pro tip for high earners: Avoid leaving money behind

High-income earners often face contribution limits and complex tax considerations. But employer match strategies still apply.

Advanced tips:

- Maximize salary deferrals: Ensure you’re contributing up to the IRS annual limit ($23,000 for 2025, plus $7,500 catch-up if over 50).

- Understand plan limits: Some plans cap matching contributions based on a percentage of income. Know your plan’s formula.

- Explore Roth options: If offered, Roth 401(k) contributions can provide tax-free growth, which may be beneficial depending on your tax bracket.

Talk with a financial professional

Maximizing your employer match can be one of the most effective ways to potentially grow your retirement savings. But every individual’s situation is unique. Whether you’re just starting out or refining a high-level strategy, speaking with a financial professional can help you make informed decisions.

Use this Ameritas financial professional finder to connect with someone who can guide you through your options and help you build a personalized plan.

Your 401(k) employer match is more than a benefit: it’s a strategic tool for wealth building potential. By contributing consistently, understanding your plan, and leveraging compounding growth, you’re taking the first step to save for your financial future.

Disclosures

Representatives of Ameritas do not provide tax or legal advice. Please refer clients to their tax advisor or attorney regarding their specific situation.

Ready to take the next step toward your financial goals?

Our website offers helpful information about our products and services, but nothing beats personalized guidance. If you're serious about improving your financial wellness, connect with a financial professional today.