How to Retire Early with a Single Premium Immediate Annuity

8 min read

8 min read

For many Americans, the decision of when to claim Social Security benefits can have a lasting impact on retirement income. While benefits can be claimed as early as age 62, waiting until full retirement age (typically 66 or 67) or even age 70 can significantly increase monthly payments. But what if you want to retire before that, say at age 62, but don’t want to lock in a lower Social Security benefit for life?

This is where a single premium immediate annuity can play a powerful, if underutilized, role.

What is the Social Security timing dilemma?

Delaying Social Security has clear financial advantages. For every year you postpone past full retirement age, your benefit grows by 8% until age 70. That’s a guaranteed return that’s hard to match elsewhere.

However, many people retire before they reach full retirement age, sometimes by choice, sometimes by necessity. The challenge becomes: How do you fund those early retirement years without dipping too heavily into your savings or locking in reduced Social Security benefits?

One answer lies in a bridge strategy, temporarily replacing the income Social Security would have provided so you can delay claiming it. And a single premium immediate annuity can be a tool to do that.

Quick summary:

- Goal: Retire early without reducing Social Security.

- Tool: Single Premium Immediate Annuity (SPIA).

- Benefit: Guaranteed income to delay claiming Social Security.

Read our blog to learn how annuities can help make sure you have enough money for retirement.

What is a single premium immediate annuity?

A SPIA is a contract with an insurance company where you pay a lump sum up front in exchange for guaranteed1, immediate income for a set period or for life. In the context of a Social Security bridge, the most relevant form is a period-certain SPIA, which provides income for a fixed number of years, say, from age 62 to 67.

Here’s how it works:

- You invest a lump sum in your immediate annuity at retirement.

- The insurer begins paying you monthly income right away.

- Payments continue for the duration you specify, such as five or eight years.

- At the end of the period, payments stop—right when you’re able to receive a higher Social Security benefit.

Learn more about single premium immediate annuities from Ameritas.

Why use a SPIA as a bridge strategy?

There are several advantages to using a SPIA to bridge the gap between retiring and claiming Social Security.

1. Maximize Social Security benefits

As mentioned, delaying benefits increases your monthly payment for life. A SPIA gives you the financial breathing room to do that without compromising your standard of living.

2. Predictable, guaranteed income

SPIAs offer certainty in an uncertain market. Unlike investment-based drawdown strategies, your SPIA payments are not subject to stock market risk. That’s particularly valuable early in retirement, when market downturns can do damage to your portfolio, a phenomenon known as sequence of returns risk.

3. Simplicity and ease

With a SPIA, there’s no ongoing investment management. You don’t need to worry about withdrawals, rebalancing or whether your money will last. It just shows up in your bank account, like a paycheck.

4. Preserve other retirement assets

Using a SPIA for early retirement income allows you to leave other retirement assets, like IRAs or 401(k)s, untouched, giving them more time to grow or last longer.

How does a bridge strategy using a single premium annuity work?

Here’s a hypothetical example to see how this strategy works.

Say you’re 62 and want to retire, but you know that waiting until age 67 to claim Social Security will give you $2,500 per month for life, $900 more than if you take it at 62. You need to replace that $2,500 monthly benefit for five years.

You could:

- Withdraw $2,500/month from your investment portfolio.

- Or, invest about $135,000 (based on current interest rates) into a 5-year SPIA that pays you $2,500/month. At the end of the five years, your Social Security kicks in at the higher rate, and your portfolio is still largely intact.

What should I consider before buying a SPIA?

Like any financial tool, SPIAs aren’t for everyone. Before you commit, here are a few things to consider:

- Liquidity. Once you buy a SPIA, the lump sum is no longer accessible. You’re trading a large upfront payment for guaranteed income, not flexibility. Make sure you have emergency funds elsewhere.

- Inflation. Most SPIAs offer level payments, meaning they don’t increase with inflation unless you buy a rider—often at an additional cost. For short bridge periods like 5–8 years, this might be acceptable, but for longer gaps, inflation risk is a real consideration.

- Health and longevity. SPIAs make the most sense if you’re in reasonably good health and expect to live a long retirement. For shorter period-certain SPIAs, this is less of an issue, since payments don’t depend on lifespan.

- Interest rates. SPIA payouts are influenced by current interest rates. If rates are low when you buy it, payouts are lower as well. However, they may still be competitive with what is considered a safe withdrawal rate from a portfolio, especially given the lack of market risk.

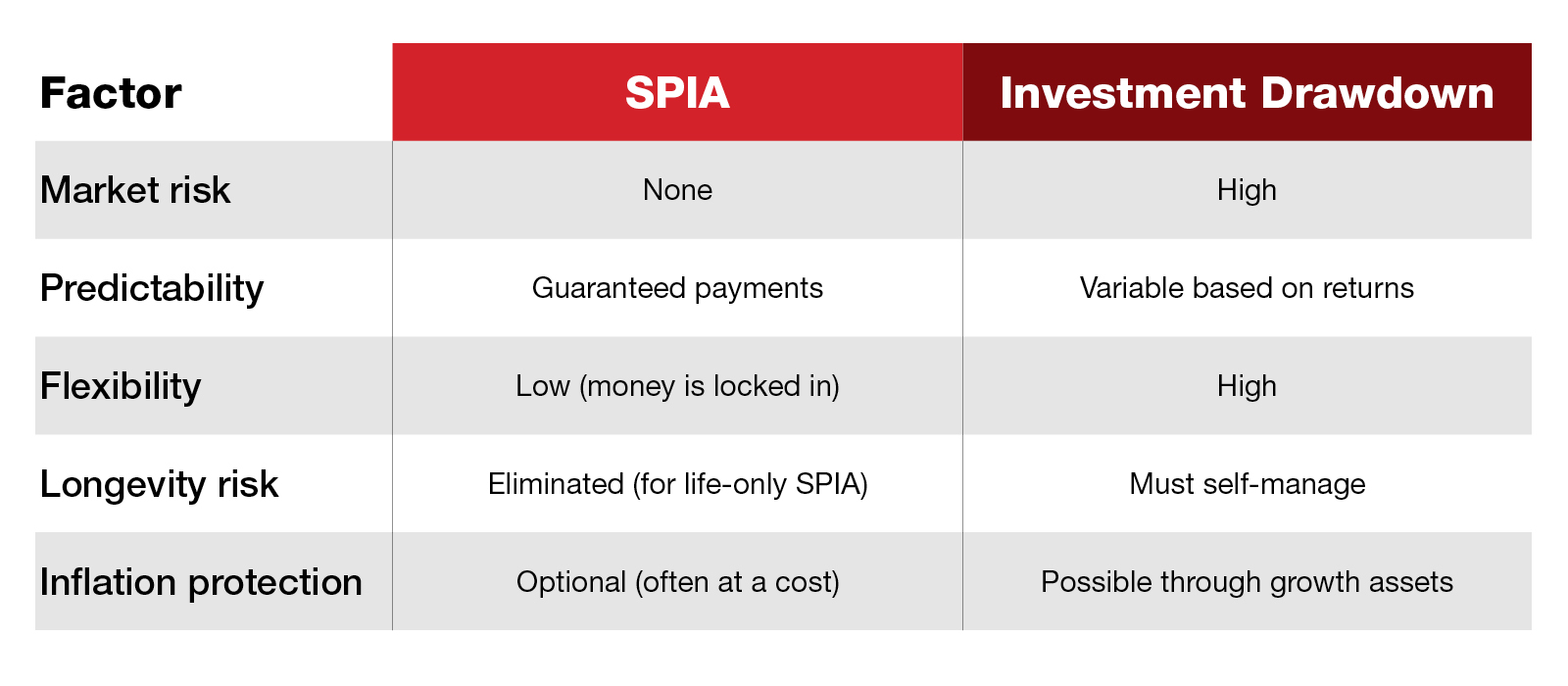

What are the pros and cons of using SPIAs vs. drawing from investments?

You might wonder: why not just take systematic withdrawals from your retirement account? That can work, but it comes with more complexity and risk. Here’s a quick comparison:

For many retirees, the advantage of guaranteed income outweighs the loss of liquidity, especially when covering a defined, short-term need like a Social Security bridge.

Is a SPIA right for your retirement plan?

A SPIA used as a bridge to delay Social Security can be an efficient way to increase lifetime retirement income while reducing investment and longevity risk. But it’s not a one-size-fits-all strategy.

If you’re thinking of retiring early but want to make the most of your Social Security benefits, talk to a financial professional who can evaluate your situation, run the numbers and help determine whether a SPIA fits into your overall retirement income strategy.

Sources and References:

1Guarantees are based on the claims-paying ability of the issuing company.

Compass SPIA (Form 2703) is issued by Ameritas Life Insurance Corp. in approved states. In New York, Compass SPIA (Form 5703) is issued by Ameritas Life Insurance Corp. of New York.

Need help with your financial goals?

While you can learn more about our products on this website, this information is no substitute for the guidance of a qualified professional. If you’re serious about assessing your financial wellness, contact a financial professional.

Do you already have an agent?