Retirement can be as exciting as traveling the world or as relaxing as spending a day on the beach. Whatever your vision is, it takes careful planning to get there. An indexing strategy may help protect you from the downfalls of a volatile market, helping you overcome other challenges such as rising health care expenses and longer life expectancies.

As you save for retirement, growth that is linked to the market is key to helping assets keep up with inflation for the long haul. An indexing strategy attempts to mimic the performance of a market index, such as the S&P 500, while minimizing exposure to volatility by providing protection from downfalls in the market.

An indexing strategy is the foundation for the calculation and crediting of interest on an indexed annuity. An indexed annuity provides the potential for cash accumulation with an interest rate that’s linked, in part, to the performance of one or more equity indexes, without exposure to loss from potential downfalls in the market. Your annuity can grow based on how an index performs, but you’re not actually buying any stocks or shares of an index. This means the money in your annuity is not at risk due to market losses. Your annuity cannot lose money due to volatility and the interest credited will never be less than zero. For example, if an insurance company issues an indexed annuity with a 0.00% floor and the index falls by 3%, the annuity owner’s premium is protected by the floor — that is, the minimum rate of 0.00%. In exchange for this floor that protects from loss, there is usually a cap on the growth of the index.

What is a cap rate?

As you investigate an indexing strategy, you might be asking yourself, what is a cap rate? Interest rate caps designate the ceiling, or maximum gains, for indexed annuities. The growth of indexed annuities aligns with the performance of a particular index. Interest rate caps denote the maximum amount of interest an annuity can earn — regardless of the change in the index.

As opposed to fixed annuities, which establish a guaranteed interest rate for a set period, indexed annuities have higher growth potential than fixed annuities. For example, if you own an indexed annuity with a 7% interest rate cap, but the index earns 12% during the contract term, the annuity will be credited only the cap of 7%, so growth is limited.

As you start to understand what a cap rate is, you may also be wondering why indexed annuities have them. The insurance company, in this case, has assumed the market risk. It has absorbed the loss. Without limiting earnings on indexed annuities, the insurance company couldn’t afford to keep these products on the market.

Think a cap will hurt your earnings?

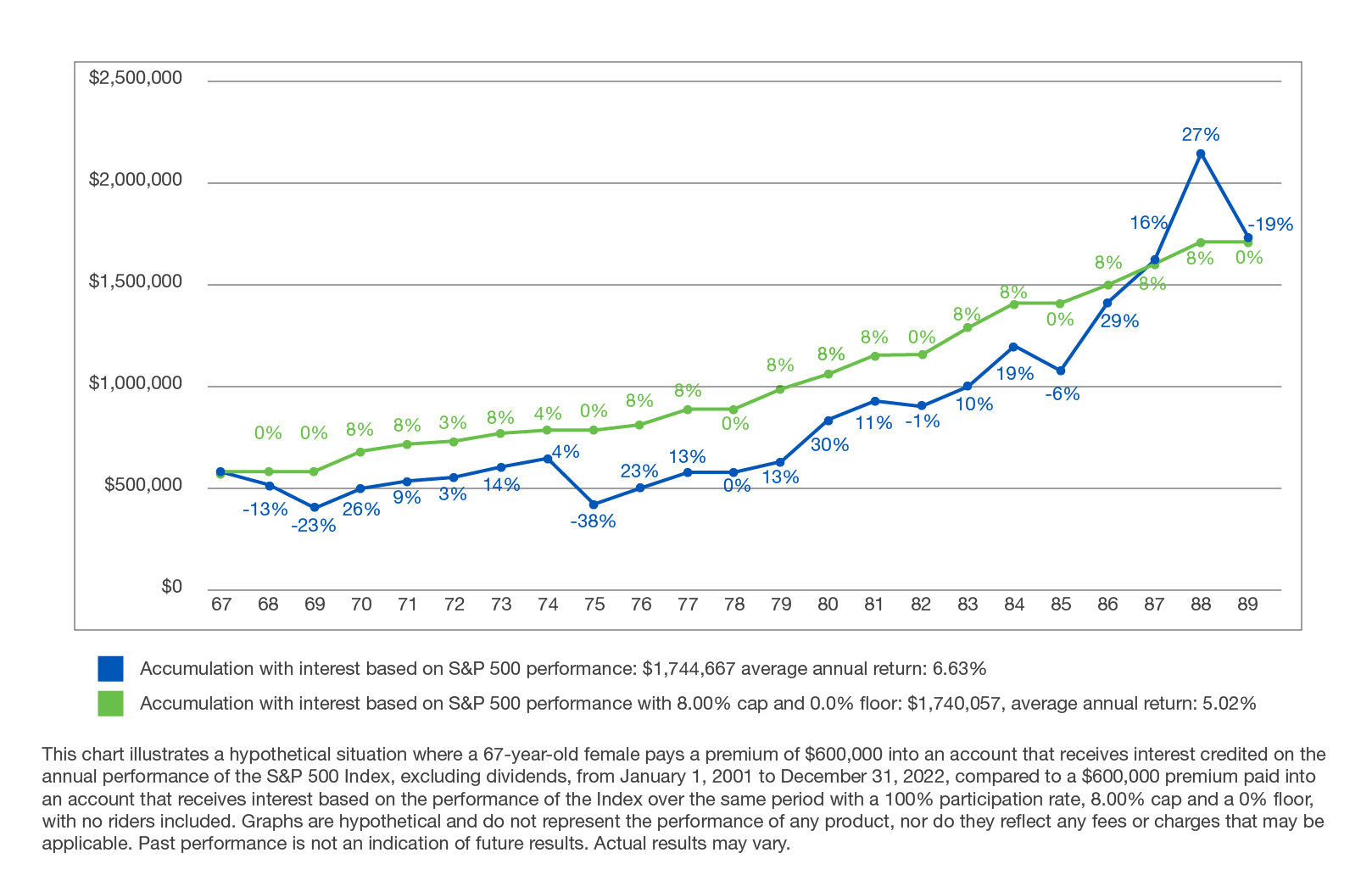

Look at a hypothetical example based on the actual performance of the S&P 500 Index from January 2001 – December 20221 to see the effects of a cap and floor. There are several ups and downs in the S&P during this time, which provides a realistic example of how an indexing strategy works during a volatile period, with many ups and downs in the market.

Notice the difference between the two values over the years. The capped option is usually higher, even though its average annual return was about 1.6% less than the uncapped option. That’s because, during periods of decreasing returns, the floor protects you from losses.

What if you need this money for retirement?

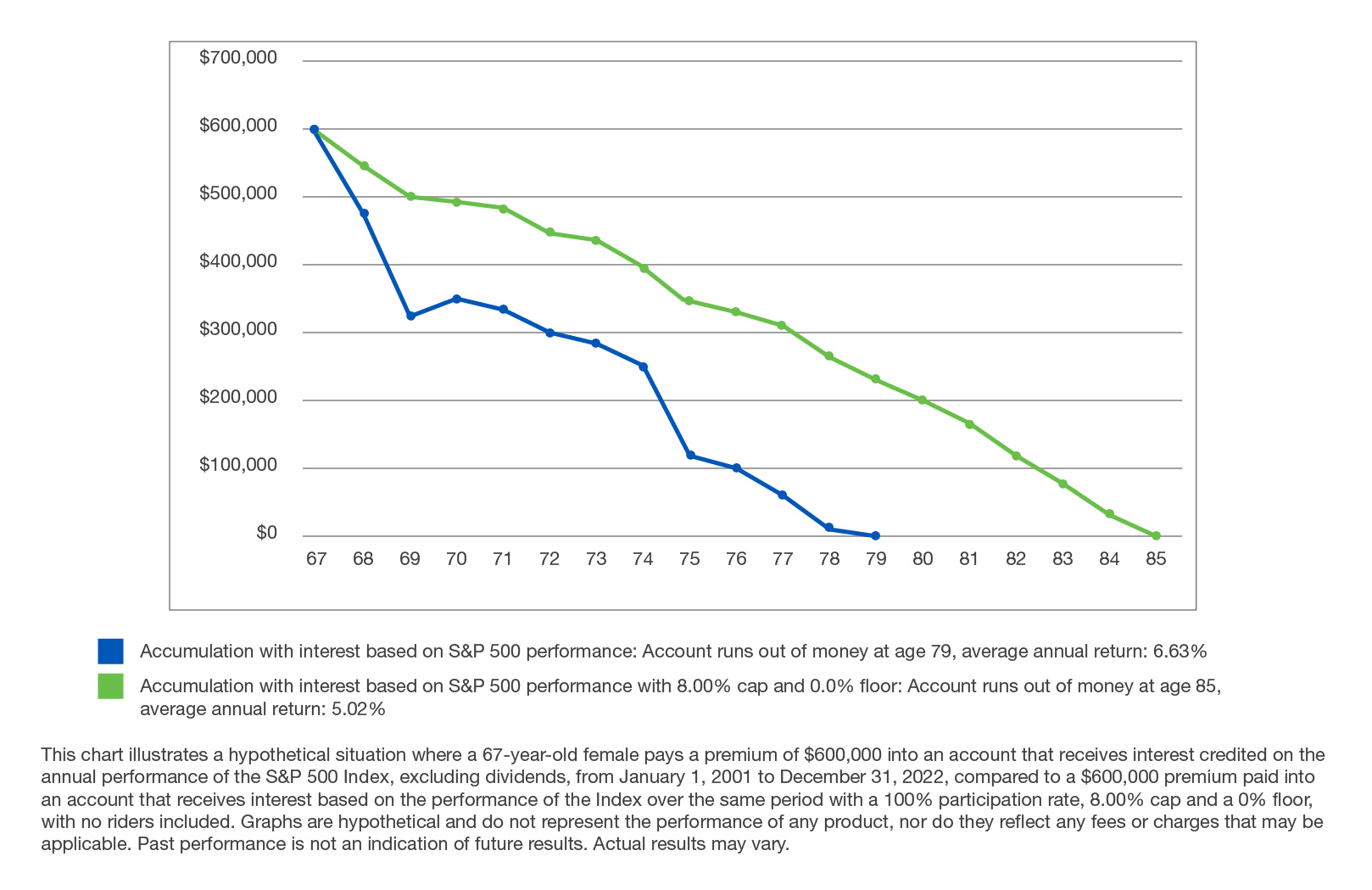

The difference becomes more pronounced when you take money out of the account. If high negative returns occur in the beginning years of your retirement, as happened in our example, there can be a lasting negative effect and reduce the amount of income you can withdraw over your lifetime. This is called sequence of returns risk.

Using an indexing strategy that provides a floor and cap can help protect against sequence of returns risk. Look at our hypothetical example again, this time with an annual withdrawal of $47,000 starting at age 68. Despite having a lower average annual return, the capped option lasts six years longer than the uncapped option.

Plan for your retirement

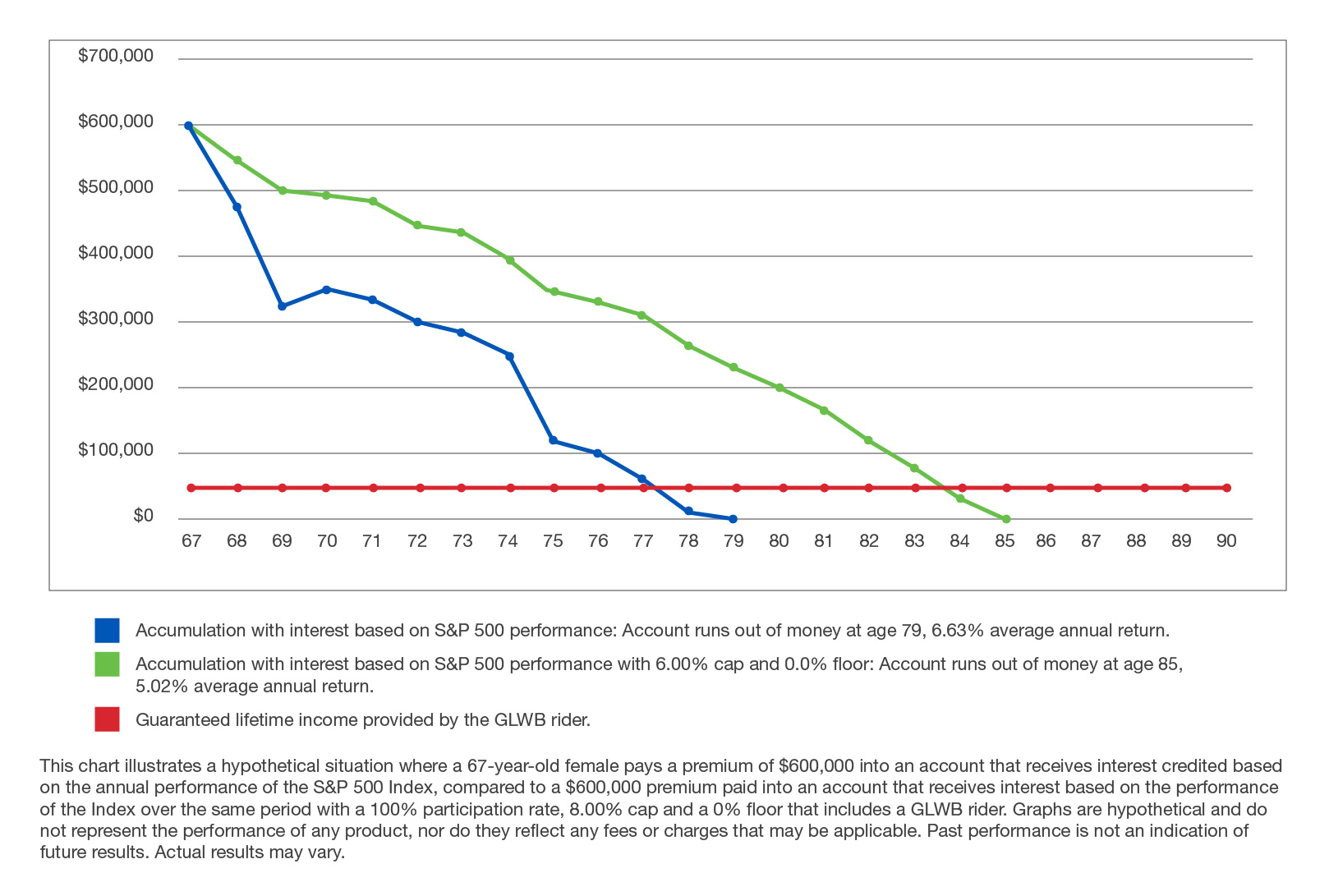

Now think about spending 20 years or more in retirement. What if you live longer than that? Some index annuities offer a Guaranteed Lifetime Withdrawal Benefit rider that may help your money last as long as you do. A GLWB rider guarantees* that the policy owner can withdraw a specified amount for their life, or for their life and their spouse’s life, even if the actual value of the index annuity decreases to zero.

In addition, some GLWB riders offer boosters. With the booster, the policy owner will receive a higher withdrawal amount if they are unable to perform two of six activities of daily living, which includes bathing, continence, dressing, eating, toileting and transferring.

Adding another five years to our hypothetical example shows the benefit of having a GLWB rider.

Protect your future

Markets are unpredictable, and volatility can have a significant impact on the amount of money you have in retirement. Now that you know what a cap rate is and how it works, consider an indexing strategy using an indexed annuity as you plan for your retirement and help protect against unnecessary risks.

Need help with your financial goals?

While you can learn more about our products on this website, this information is no substitute for the guidance of a qualified professional. If you’re serious about assessing your financial wellness, contact a financial professional.

Do you already have an agent?

Sources and References:

*Guarantees are based on the claims paying ability of the issuing company.

1Standard and Poor’s

Information was gathered from sources believed to be reliable; however, we make no representations as to its completeness or accuracy. All economic and performance information is historical and is not indicative of nor does it guarantee future results. This information should not be construed as investment, legal, or tax advice.

Unless otherwise specified, any person or entity referenced herein is not an affiliate of Ameritas Life Insurance Corp. or any of its affiliates.

Policies, index strategies, and riders may vary and may not be available in all states. Optional riders may have limitations, restrictions, and additional charges.

Withdrawals may be taxable and, if taken prior to age 59 ½, a 10% penalty tax may also apply.

The information presented here is not intended as tax or other legal advice. For application of this information to your specific situation, you should consult an attorney.

Standard & Poor’s 500® Index is comprised of 500 stocks representing major U.S. industrial sectors. S&P 500® and Standard & Poor’s 500® are trademarks of Standard & Poor’s and have been licensed for use by Ameritas Life Insurance Corp. The product is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’s does not make any representation regarding the advisability of investing in the product.