Is Employer Life Insurance Enough? What You Should Know

8 min read

8 min read

Employer life insurance is a valuable benefit that many companies offer as part of their employee benefits package. It provides group life insurance coverage to eligible employees, often at little or no cost. While convenient and cost-effective, employer-sponsored life insurance may not be sufficient to meet all your financial protection needs, especially if you have dependents or long-term financial goals.

In this article, we’ll explore the key features of employer life insurance, compare it to individual life insurance, and help you determine the best strategy for protecting your loved ones.

What is employer life insurance?

Employer life insurance is a group policy provided by an employer to its employees. It typically includes basic coverage, such as one or two times your annual salary, and may offer the option to purchase additional coverage at discounted group rates.

Key features of employer life insurance:

- Employer-sponsored premiums: Employers often pay for basic coverage, making it a cost-effective way to secure life insurance. Employees can usually buy supplemental coverage at lower rates than individual policies.

- Simplified underwriting: Most employer life insurance policies do not require a medical exam. This makes coverage accessible to employees with pre-existing health conditions or those who might otherwise struggle to qualify for individual coverage.

- Limited customization: Coverage amounts are often tied to salary multiples, and options for riders or policy enhancements are minimal.

- Portability concerns: Coverage typically ends when you leave your job. Some plans offer conversion options, but these can be expensive or limited.

- Cost-effective coverage: Group rates and employer subsidies make this an affordable way to secure basic life insurance protection.

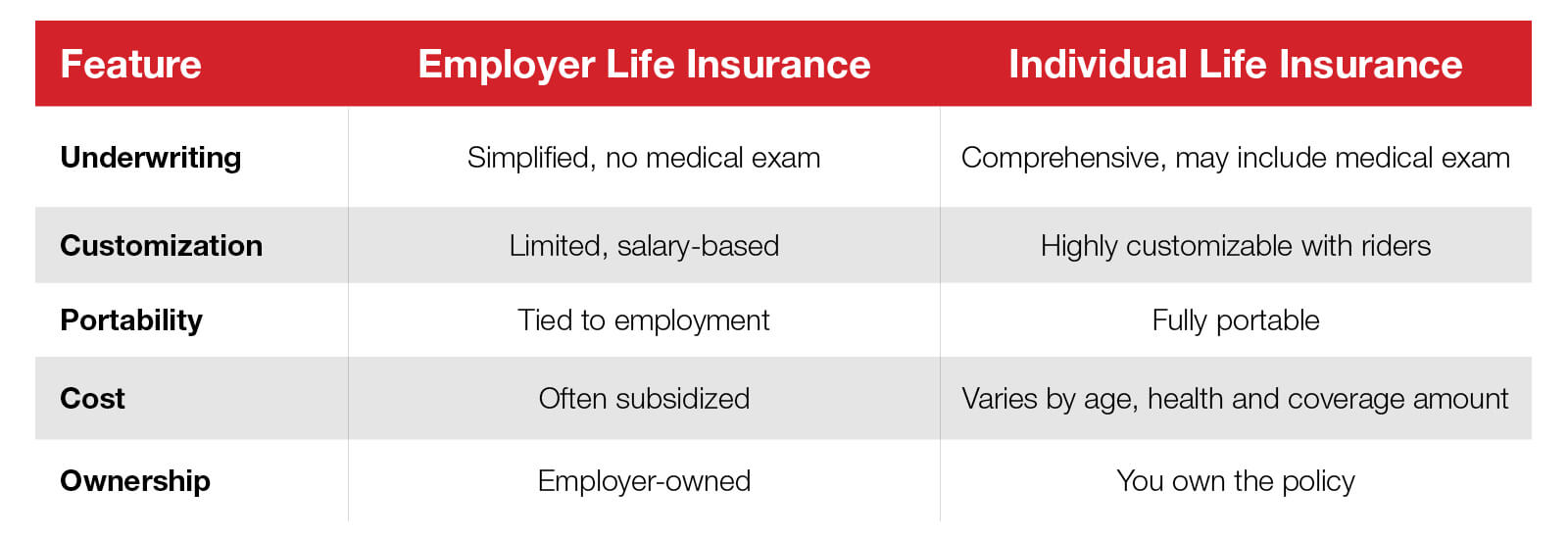

Individual life insurance vs. employer life insurance

While employer life insurance offers convenience, individual life insurance provides greater flexibility, control and long-term protection. Here’s a side-by-side comparison:

4 questions to ask about employer life insurance

Before relying solely on employer life insurance, consider these important questions to ensure your coverage aligns with your financial needs.

1. Are you in good health?

If you’re young and healthy, you may qualify for lower premiums with an individual policy. While employer life insurance is beneficial for those with health issues, it may not offer the best rates for healthy individuals. Individual policies often have more rate classes, rewarding good health with lower premiums.

Tip: Compare quotes from individual insurers to see if you can get better coverage for a similar or lower cost.

2. Is your group coverage discounted?

Many employees sign up for employer life insurance because it’s free or heavily discounted. While this is a great perk, it’s important to assess whether the coverage amount is sufficient. A basic policy may not cover your mortgage, debts or future expenses like college tuition.

Tip: Conduct a life insurance needs analysis to determine if you need supplemental coverage.

3. What happens if you leave your job?

Employer life insurance is tied to your employment. If you change jobs, retire or are laid off, your coverage may end. Some policies offer conversion options, allowing you to switch to an individual policy, but these can be costly and may offer reduced benefits.

Tip: Consider purchasing an individual policy while you’re still employed to avoid gaps in coverage later.

4. Do you have adequate coverage?

Group policies often cap coverage at a multiple of your salary, which may not be enough for families with dependents or long-term financial obligations. Individual policies allow you to choose higher coverage amounts and add riders for extra protection.

Tip: Use online calculators or consult a financial professional to determine your ideal coverage amount.

This article can also help: Do You Have Enough Life Insurance?

Customization and flexibility: why individual life insurance matters

One of the biggest advantages of individual life insurance is the ability to tailor your policy to your unique needs. You can choose between term life, whole life or universal life insurance. You can customize your policy by adding extra features, called riders, to help meet your current and future life insurance needs. These riders allow you to:

- Help ease the financial strain of a serious medical condition by providing a part of your policy’s death benefit while you’re living.

- Provide more money to your beneficiaries if your death is accidental.

- Keep your policy in force or pay your policy’s premiums if you become disabled.

- Provide a guaranteed stream of payments for life, helping to supplement your retirement income needs.

These options provide added protection and flexibility that employer life insurance typically doesn’t offer.

Read this article to understand the difference between permanent and term life insurance.

Combining employer and individual life insurance

There’s no one-size-fits-all when it comes to life insurance. Many people benefit from combining employer life insurance with an individual policy to ensure comprehensive protection.

Why combine?

- Employer life insurance provides basic, affordable coverage.

- Individual life insurance offers long-term protection, customization and portability.

By layering both types of coverage, you can protect your family from unexpected financial hardship while maintaining flexibility as your career and life evolve.

Choosing the right life insurance strategy

Employer life insurance is a valuable benefit that offers affordable, accessible coverage, especially for those with health concerns or limited budgets. However, it may not provide the level of protection needed for long-term financial protection.

Individual life insurance gives you control and flexibility. It’s well-suited for those who want to tailor their coverage to their financial goals, family needs and future plans.

Key takeaways:

- Don’t rely solely on employer life insurance for long-term protection.

- Evaluate your financial situation, health status and coverage needs.

- Consider combining employer and individual policies for comprehensive coverage.

- Consult a licensed financial professional to create a personalized life insurance strategy.

Explore life insurance options from Ameritas to find the right coverage for your needs and goals.

In approved states, life insurance is issued by Ameritas Life Insurance Corp. In New York, life insurance is issued by Ameritas Life Insurance of New York. Policies and riders may vary and may not be available in all states. Optional riders may have limitations, restrictions, and additional charges.

Ready to take the next step toward your financial goals?

Our website offers helpful information about our products and services, but nothing beats personalized guidance. If you're serious about improving your financial wellness, connect with a financial professional today.