Having a business exit strategy means planning for the unexpected – financial hardship, health challenges and even death. It also means having a plan for the transfer of ownership of your business when it comes time for you to retire. Failure to have an action plan for these events can be costly to you, your family and your business.

As a business owner, you’ll decide when to step out of the family business and how you’ll do it. These are your options:

- Plan for family succession.

- Sell the business.

- Liquidate the business and sell the assets.

You should also plan for what will happen with your business if you were to experience a disability. Business Overhead Expense insurance helps cover business expenses during a disability. When sickness or injury prevents you from working, this coverage can help keep your business running. It helps you focus on getting better and returning to work or keeping the business open until you are ready to sell it. Read more about disability income insurance for business owners.

A written business continuation plan, such as a buy-sell agreement, provides clear instructions on how the business should be managed and who should assume leadership roles in various scenarios. It helps to protect the business’s interests, ensure continuity of operations, and provide stakeholders with confidence in the business’s ability to navigate challenges and transitions effectively. A well-thought-out, adequately valued and funded buy-sell agreement can:

- Assure a buyer for the business.

- Assure the business owner’s family a fair value for the business while reducing the costs and delays of probate.

- Reduce the risk of a proposed assessment from an IRS audit.

- Spell out the terms of the buyout, which can be funded with life insurance.

- Provide a smooth transition of complete control and ownership.

- Assure business continuity.

You should also include the plan for your business in your will and inform your family about it. This can help ensure a smooth and orderly transition of your family business, while also preserving family relationships and minimizing the risk of legal disputes.

Where do I start?

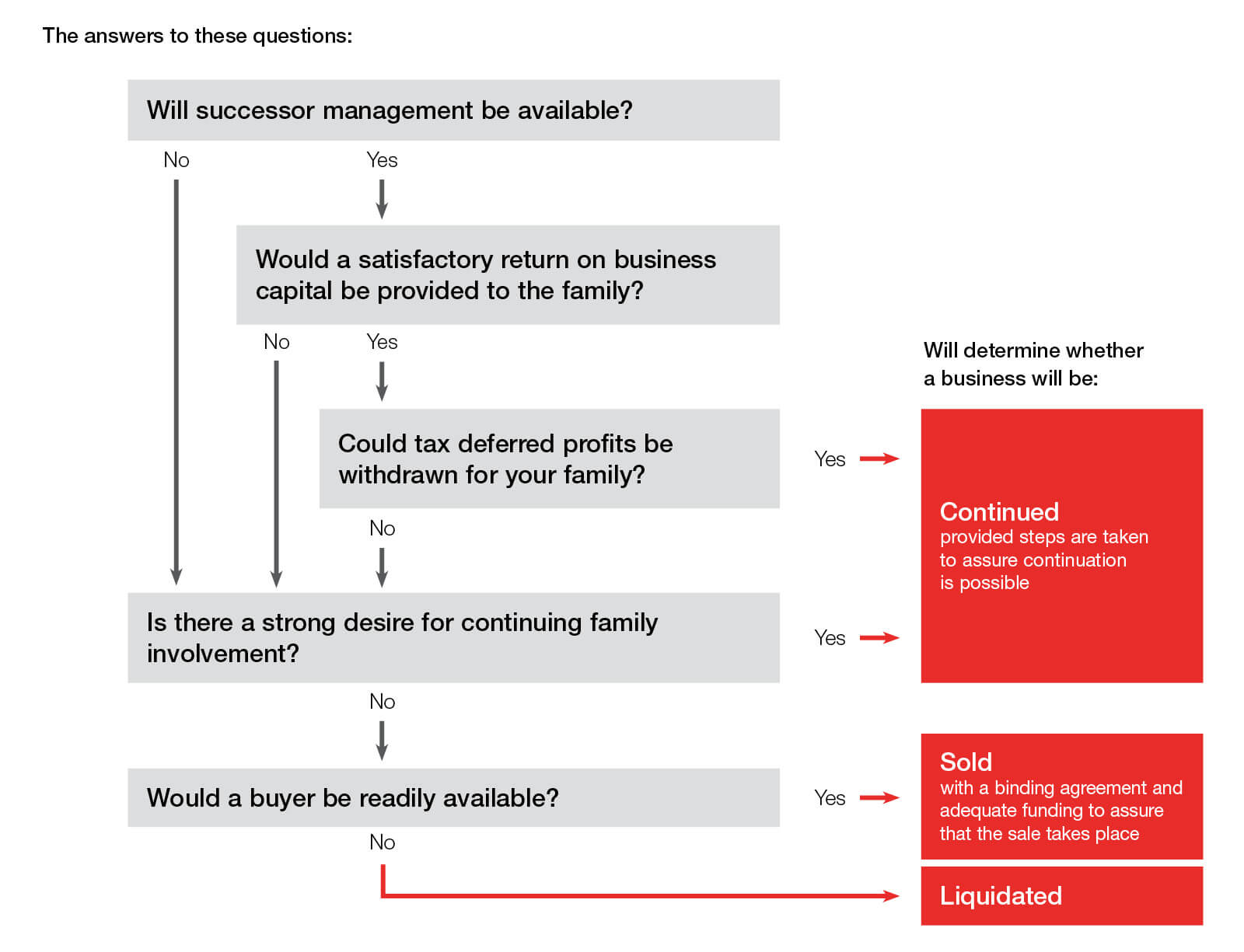

As you put plans in place, consider the following questions about the future of your business:

Will successor management be available and willing to run your business?

A successor manager can cover your unexpected absence from the business in case of death or disability and can serve as interim management during the transition period after your withdrawal from the business.

Would a satisfactory return on business capital be provided to the family?

Sufficient profit is needed to support the successor’s family and to make payments for the purchase of the business.

Could tax deferred profits be withdrawn for your family?

In order to grow, a small business may need to use a relatively large percentage of profits. This may not be acceptable to some family members, especially those who are owners but not employees of the company.

Is there a strong desire for continuing family involvement?

Transferring the business to the next generation only works if that generation is willing and able to carry on the business.

Would a buyer be readily available?

Is a key person or competitor a suitable candidate? Potential buyers are often few and may not want to invest for the same reasons your heirs have declined the opportunity.

Keeping your business in the family offers the advantage of having future leaders who know the business and have a long-term outlook. However, keeping the family in the business depends on the presence and ability of a qualified heir, a stable financial scenario and a comprehensive succession strategy.

Consider life insurance as part of your strategy

Life insurance can play a part in helping you make sure your business carries on after you’re gone. The death benefit will provide cash to your heirs to:

- Buy the business from the surviving spouse, ensuring his or her financial security.

- Pay estate taxes at the parents’ deaths without having to liquidate any business assets.

- Treat family members not involved in the business equitably.

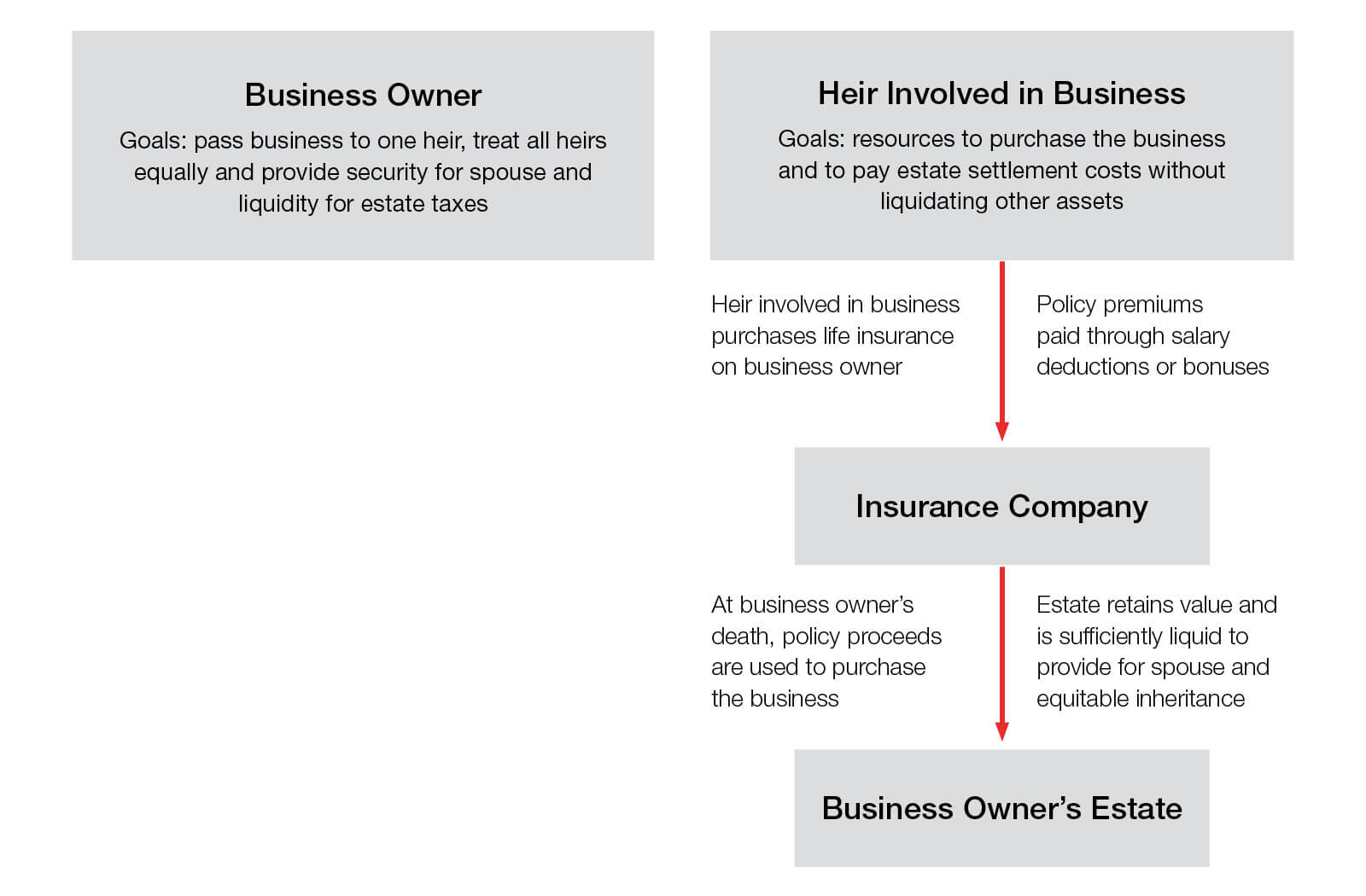

The heir who is involved in the business and who will eventually inherit it buys a permanent life insurance policy on the business owner’s life. The policy premiums can be paid by the heir, either through salary deductions or bonuses. When the business owner dies, the heir buys the business from the surviving spouse using the life insurance benefits. The purchase amount goes back into the estate and the estate uses a part of these funds to pay any estate taxes owed. The estate retains its value and is sufficiently liquid to assure that the surviving spouse is financially protected and that other heirs receive their equitable inheritance.

How it works

More about estate equity

As you work to pass your assets to your children or other loved ones, the goal is usually to divide the estate or inheritance equally among your heirs. You may have specific plans for certain assets. For example, one of your children may be involved in the family business while others are not. Depending on the size of the business in relation to the total assets of your estate, this can create inequity in an inheritance.

Splitting illiquid property such as a business among heirs can be the most difficult aspect of estate planning. An unbalanced estate may create family discord, while preventing heirs from receiving their designated inheritance.

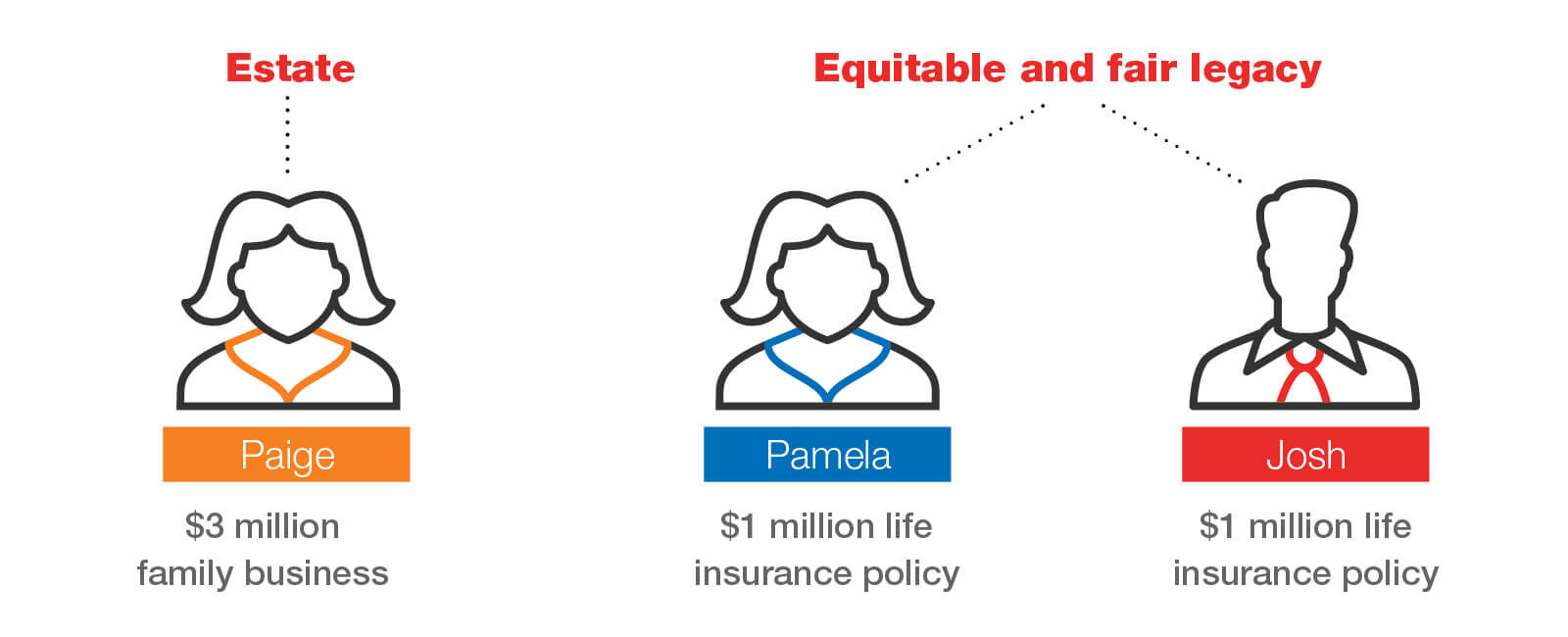

Equitable family business example

Consider the story of a hypothetical couple, Steve and Rhonda, who own a successful business and have three grown children: Josh, Paige and Pamela. Paige has been running the family business for several years, while Josh is an accountant with his own practice and Pamela is a teacher. Steve and Rhonda want Paige to take over the business, keeping it in the family. However, as the business makes up the bulk of Steve and Rhonda’s $3 million estate, they are concerned about treating the other two children fairly. Including life insurance as part of their estate plan can be a simple and cost-effective way to ensure that Steve and Rhonda’s children will receive an equitable, if not equal, inheritance. The business goes to Paige after Steve and Rhonda pass away and a life insurance policy with a death benefit of $2 million will provide for Josh and Pamela. Note that Josh and Pamela are not receiving death benefits equal to the value of the business, as they will receive the life insurance proceeds income tax free with complete liquidity and will have no responsibility for maintaining the business.

The children are all treated equitably. Paige gets to run and enjoy the fruits of the family business, without having to liquidate any part of it to settle the estate. Josh and Pamela, who are not involved in the business, get a fair inheritance and are not burdened by the responsibility of the business. This arrangement helps avoid jealousy between the siblings and ensure continuation of the family business.

What will happen to your family business?

Succession planning for your family business is essential to make sure your wishes are met and ensure a successful transition of your business. Find a financial professional today to help you start the process by helping you answer the necessary questions, get a proper business valuation, and put the proper agreements into place.

Need help with business planning products?

From comprehensive business planning to employee benefits, we can help create a financial strategy that’s best for your business.