How do you make wealth last beyond your lifetime? For many families, the answer is a trust, a legal arrangement that allows one person or entity, known as the trustee, to manage assets for the benefit of another person or group, referred to as the beneficiaries. The individual who creates the trust is called the grantor, and they set the rules for how the assets should be handled and distributed. Trusts are often used in estate planning to protect assets, reduce taxes and promote that wealth is passed on according to the grantor’s wishes.

A multi-generational trust, also known as a dynasty trust, allows families to preserve wealth for future generations. It offers advantages such as reduced estate taxes, asset protection against legal challenges and support for responsible wealth management. This trust structure helps protect a family’s legacy and promote that assets are used according to the grantor’s intentions.

Learn more: Understanding the Basics of Estate Planning

Why use a multi-generational trust in estate planning?

Choosing this tool for your estate plan serves several important purposes:

Preserve wealth across generations

Without a plan, inherited wealth can quickly disappear from poor management, taxes or family disputes. A multi-generational trust that can help protect assets, with trustees distributing funds in accordance with the grantor’s wishes. This helps promote that wealth lasts and is used wisely for future generations.

Minimize estate and GST taxes

Dynasty trusts bypass estate taxes at each generation. By utilizing lifetime gifts and generation-skipping transfer (GST) tax exemptions, families can transfer assets into a trust, allowing them to grow free from estate and GST taxes, regardless of any appreciation.

Protect assets from legal and financial risks

Trust assets are typically protected from lawsuits, bankruptcy and divorce, thereby preserving them within the family and promoting their intended use.

How dynasty trusts grow tax-free over time

Beyond avoiding estate and GST taxes, dynasty trusts promote that assets can grow tax-free across generations. Because the trust owns the assets, income and gains are not subject to transfer taxes when passed to future beneficiaries.

If the grantor uses gift and GST exemptions properly, the trust may have a zero inclusion ratio, so future payments to later generations aren’t taxed under GST rules.

Once inside the trust, assets can:

- Appreciate without triggering estate or transfer taxes.

- Be invested in portfolios, real estate or life insurance to help maximize long-term growth potential.

- Assets in the trust may remain and grow for hundreds of years in qualifying states.

Many families fund the trust with life insurance, which provides a tax-free death benefit and can boost the trust’s value when the grantor dies. With strategic planning and investing, the trust benefits heirs and grows tax-free for years.

How does a dynasty trust work?

The following hypothetical example shows how these trusts function in practice.

The Johnson Family Dynasty Trust with life insurance

Bill Johnson has a $12 million estate and wants it to benefit his descendants. Concerned about estate taxes and preserving his wealth, he works with an estate planning attorney to create a dynasty trust in Nevada, a state with favorable trust laws.

Bill buys a $5 million whole life policy, naming the trust as both the owner and beneficiary to keep it outside his estate and ensure the death benefit is paid to the trust.

A corporate trustee manages the trust’s assets, including the life insurance. Bill sets rules for how money is distributed: his children receive an annual income, and his grandchildren can use funds for education, a first home or starting a business. The trust also has a rule to protect assets from creditors and poor financial choices.

When Bill dies, the trust receives the $5 million life insurance death benefit. The trustee pays estate taxes and then distributes the remaining assets in accordance with the trust rules. Remaining assets stay in trust for beneficiaries and continue to grow, avoiding estate and GST taxes.

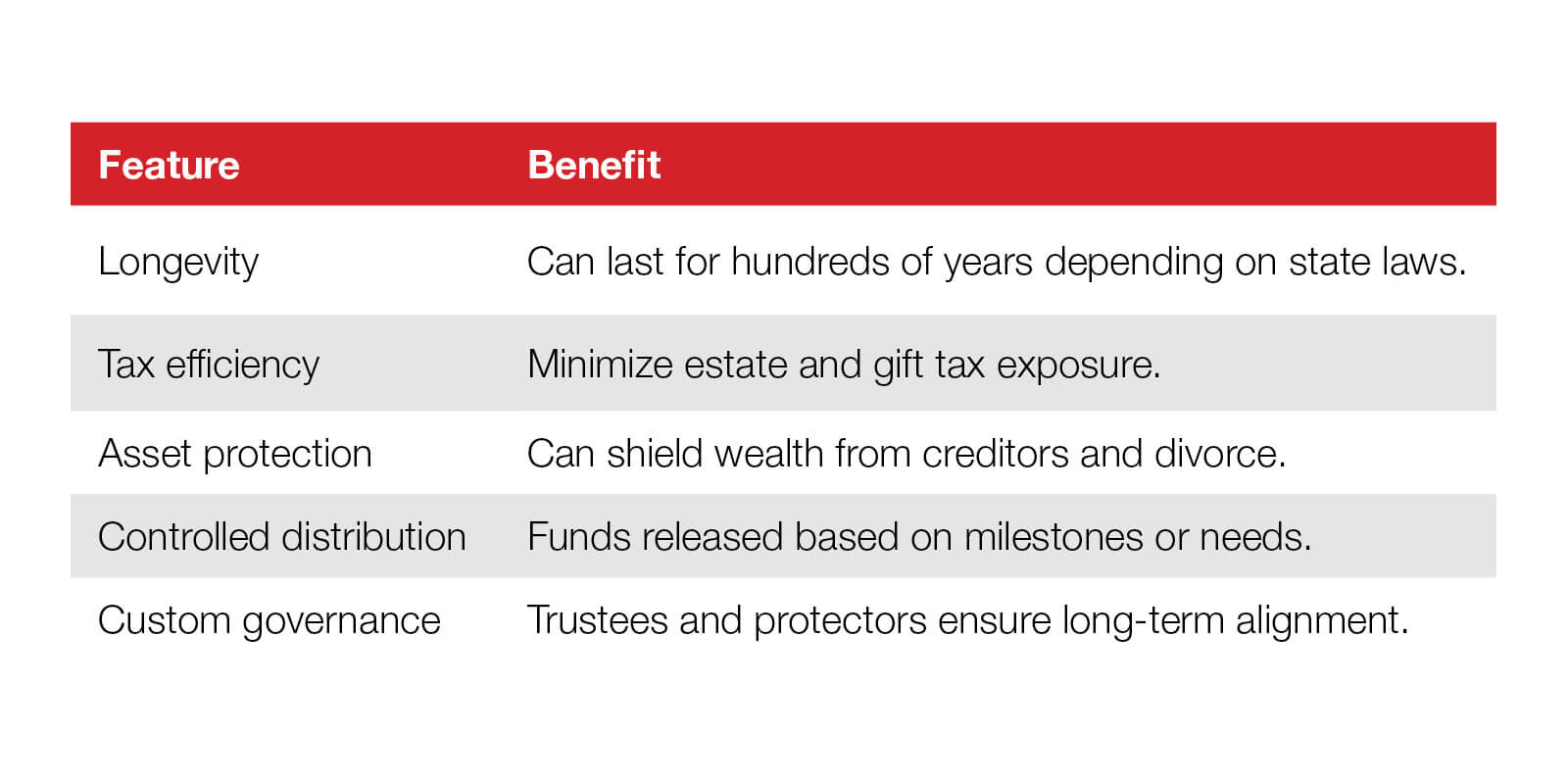

Key features of multi-generational trusts

Jurisdiction matters: how state laws affect multi-generational trusts

One of the most important and often overlooked factors in setting up a multi-generational trust is where it is set up. State laws vary widely in how they treat long-term trusts, and choosing the right jurisdiction can greatly affect the trust’s longevity, tax efficiency and asset protection.

States with favorable trust laws

Some states have abolished or extended the traditional Rule Against Perpetuities, allowing trusts to last for hundreds of years or even indefinitely. These states are especially attractive for dynasty trusts:

- South Dakota.

- Nevada.

- Alaska.

- Delaware.

- Wyoming.

In addition to allowing perpetual trusts, these jurisdictions often offer:

- No state income tax on trust assets (not including Delaware).

- Strong asset protection laws.

- Enhanced privacy for beneficiaries.

- Flexible trust administration rules.

Establishing a trust in one of these states can help families preserve wealth while minimizing legal and financial risks.

Setting up a trust in a state you don’t live in

You don’t need to live in a state to set up a trust there. Many families take advantage of favorable jurisdictions by:

- Appointing a trustee who lives or operates in the chosen state (often a corporate trustee).

- Ensuring trust administration, such as recordkeeping and decision-making, occurs in that state.

- Including a governing law clause in the trust document specifying which state laws apply.

This way, families can use another state’s legal benefits while staying flexible. It’s important to consult an estate planning attorney to understand the tax rules and ensure compliance with the laws in both your home state and the state where the trust is set up.

Key elements of a multi-generational trust

1. Jurisdiction options

Some states permit perpetual trusts and have laws that impact taxation and privacy. These factors often influence where a trust is established.

2. Distribution framework

Trusts can include conditions for when funds are distributed. Examples of common milestones include reaching a certain age, completing higher education, starting a business or purchasing a first home. These provisions often reflect family priorities and values.

3. Roles in trust management

Trusts typically involve a trustee – an individual or institution responsible for administration. In some cases, a trust protector is added to oversee changes and maintain alignment with the trust’s original intent.

4. Funding methods

Assets frequently placed in multi-generational trusts can include real estate, investment portfolios, life insurance policies and business interests. Funding during the grantor’s lifetime can have implications for tax treatment and long-term growth.

Frequently asked questions

How long can a multi-generational trust last?

Depending on the state, some trusts can last indefinitely. States with favorable laws allow perpetual trusts that span multiple generations.

Can I change the terms of a multi-generational trust?

Irrevocable trusts are hard to change, but some let a trust protector make adjustments.

Who should consider a multi-generational trust?

Anyone with significant assets who wants to preserve wealth, avoid taxes and protect heirs.

Common mistakes to avoid

- Choosing the wrong trustee: Mismanagement can lead to conflict or asset loss.

- Ignoring state laws: Trust duration and tax treatment vary.

- Lack of communication: Discussing your intentions with heirs prevents confusion.

Secure your legacy with a multi-generational trust

Multi-generational trusts help shape your family’s future. With good planning, you can ensure your values and resources last.

Learn more about estate planning in this podcast episode from Ameritas.

Disclosures

Representatives of Ameritas do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your specific situation.

Ready to take the next step toward your financial goals?

Our website offers helpful information about our products and services, but nothing beats personalized guidance. If you're serious about improving your financial wellness, connect with a financial professional today.