Understanding the Basics of Estate Planning

8 min read

8 min read

You’ve spent your life building equity in your home, making your car payments and building a profitable stock portfolio. But do you have a plan detailing what happens to all those assets after you die? Knowing the basics of estate planning is important for anyone with any kind of asset, no matter its worth. It can help you determine exactly who you want your properties distributed to, and it puts the management of that disbursement into the hands of someone you trust.

In the end, creating an estate plan gives you control over your properties even after you’re gone. It can also prevent conflict between your beneficiaries. The definition of an estate plan is a plan designed to manage and distribute your assets, wealth and responsibilities after you are unable to manage them. An estate plan doesn’t only account for your wishes upon your death, it also serves as a plan to honor your wishes if you become disabled or incapacitated. The basic components of an estate plan typically include a living trust, a will, financial power of attorney and a medical directive.

Continue reading to learn more about the basics of estate plans and why you should start putting one together.

Why do you need to prepare a will or trust at all?

When you write an estate plan, you get to decide who receives which of your assets and, maybe more importantly, who’s in control of them. By selecting an individual you trust to handle your assets, you can rest easy knowing that your assets will be distributed in the way you intend.

A person who dies without a will is said to be intestate. Those who die intestate have an estate plan imposed on them by the state in which they lived at the time of their death. Any personally owned asset subject to probate will be governed by the rules of intestate succession. (Probate is the legal process of validating your will in court.) Each state has its own variations on intestate succession. No matter which jurisdiction, the state-imposed rules are likely to make different decisions than you would.

This is why it’s important for you to make a plan to ensure your final wishes are carried out correctly. The most common pieces of an estate plan are a will and beneficiary designations. A will describes how you want your assets distributed at your death. A beneficiary is the person you select to receive your assets. Planning an estate may include these features:

- Will.

- Beneficiary designation.

- Transfer-on-death (or pay-on-death) designation.

- Specific titling.

- Contract.

- Living trust.

What is a living trust, power of attorney and medical directive?

During the process of preparing an estate plan, you should consider making advance directives. Unlike wills, which only deal with transfers at death, advance directives are aimed at sickness, death or end-of-life decisions. Advance directives generally fall into three categories: living trusts, powers of attorney and a medical directive.

A living trust allows your beneficiaries to avoid the probate process in court. As mentioned before, when you die your will must be validated by the court before your assets can be distributed. In a living trust, the ownership of your assets and property are transferred to the trust. This allows your beneficiaries to access your assets as soon as you die instead of waiting on the probate process. Unlike a will, which only goes into effect after your death, a living trust is active should you become incapacitated and unable to manage your assets while you’re living.

Medical directives may include information regarding your desire for such services as antibiotics, hydration, feeding and resuscitation. Under a health care power of attorney, you designate another person to make health care decisions if you’re unable to do so.

Under a financial power of attorney, you transfer the right to make financial decisions to one or more agents. The document typically allows the agent to make deposits, write checks and pay bills on your behalf. The financial power of attorney is generally one of two types: the durable power of attorney or the springing power of attorney.

The durable power of attorney is designed to be effective immediately upon its execution. The main advantage of it is that the agent does not have to prove anything to act on behalf of the client. The springing power of attorney becomes effective only after a triggering event. The triggering event might be a doctor writing a statement saying you’re incapable of handling your own affairs. The advantage of a springing power is that it helps protect against possible abuse by the agent.

Fiduciaries: How to pick them?

Whether you choose a will or living trust approach, you must pick the person, people or institution to oversee the administrative work after death as part of the basics of estate planning.

A fiduciary is someone who manages your money or property and must do so with your best interests in mind. The main jobs are that of executor of the will and trustee of any trusts. The most important characteristics to seek for either role are financial responsibility, stability, strong organizational skills, respect for rules and trustworthiness.

The executor’s job is to:

- Collect the assets of the decedent.

- Protect the estate property.

- Prepare an inventory of the estate.

- Follow the rules in the will.

- Keep the family members of the decedent informed, as required.

- Pay the legitimate claims (including taxes) against the estate for which resources exist.

- Represent the estate in claims against others.

- Distribute the estate property to the beneficiaries.

- Report to the probate court as required.

The trustee’s job is more long-term. Like the executor, the trustee must protect the property in the trust, follow the rules, keep family members informed, pay bills and make distributions as required by the document. In addition, the trustee usually directs the investment details of the trust’s assets.

What do you need to know about estate taxes?

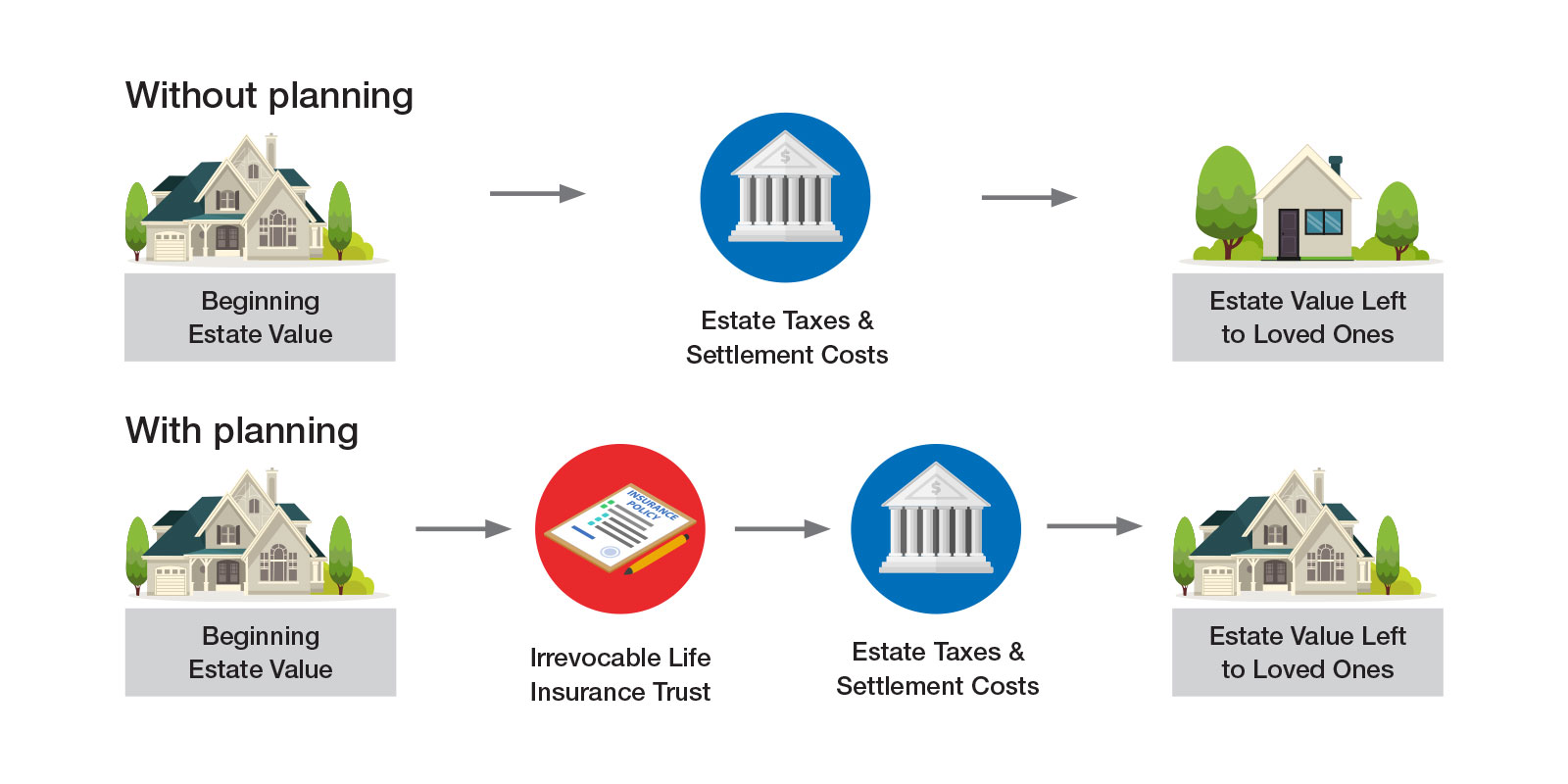

Most estates simply aren’t big enough to be subject to estate taxes. However, if your estate value is large enough, you need to be wary of how estate taxes can erode its value. While every estate has settlement costs, larger estates may be vulnerable to taxes tearing apart long-held legacies, inheritance desires and even family businesses. Read these helpful FAQs from the IRS to learn more.

Keep in mind, no matter the size of your estate, there are additional costs that can reduce the amount left to your loved ones:

- Even if your estate isn’t big enough to owe federal estate tax, your state may still take a bite. Many states collect their own estate or inheritance taxes.

- Inherited retirement assets are often subject to federal and state income tax, as well as possible federal and state estate tax.

- For smaller estates, many costs—end-of-life medical expenses, funeral costs, credit card and other debt, attorney’s fees, court costs and others—make up a larger percentage of the total estate.

Through the purchase of life insurance held in a properly structured irrevocable trust, estate assets can be protected. The irrevocable trust serves to shield the life insurance from inclusion in the estate value. The death benefit can be used to offset settlement costs and pay taxes. Most importantly, estate assets and family businesses are held together, preserving legacies for your loved ones.

Remember that Congress can always change the tax law at a future date. It’s important to stay educated and know what the laws are and whether there could be any impact to your estate. For example, under the current tax reform law, the increased basic exclusion amount is only temporary. As of January 1, 2026, the current lifetime estate and gift tax exemption of $12.92 million for 2023 will be cut in half and adjusted for inflation. That means if your estate is valued at more than $6 million, it may be subject to federal estate taxes.

Team up with Ameritas

Don’t put off preparing for the future. Planning your estate now means you can relax knowing your loved ones are well cared for after you’re no longer here.

Ameritas is in the business of fulfilling life. Bringing you valuable information to help you plan well and enjoy life is part of what we do. Contact your financial professional or contact us to connect you with a qualified professional.

Neither Ameritas Life Insurance Corp. nor its representatives provide tax or legal advice. You may want to consult your attorney or other tax professional for more information.

Need help with your financial goals?

While you can learn more about our products on this website, this information is no substitute for the guidance of a qualified professional. If you’re serious about assessing your financial wellness, contact a financial professional.

Do you already have an agent?