Inquiring about your clients’ prior employment history helps you find whether they have any abandoned retirement accounts. Since many 401(k) participants are unsure of what to do with their workplace plan, this supplies an opportunity to help your clients reach their financial goals.

There are generally four choices:

- Keep some or all the assets in the former employer’s plan.

- Transfer assets to the new employer’s plan.

- 401(k) rollover to an IRA.

- Cash out the balance.

A 401(k) rollover to an IRA may help your clients combine their retirement savings while keeping its tax-deferred status. Examining 401(k) rollover rules, along with investment options, fees and expenses, withdrawal requirements and potential penalties and tax consequences can help them decide if rolling over into an IRA is right for them.

There are some specific situations where it’s important to know how the 401(k) rollover rules apply.

Highly appreciated company stock

If your client owns highly appreciated company stock in their 401(k), special 401(k) rollover rules for what’s called net unrealized appreciation (NUA) can result in significant tax savings. When rolling money over from their employer’s plan, you want to separate the basis (what it was worth when they received the stock) from the gain. The client moves the basis to a taxable account and rolls the rest of the assets to an IRA. This requires your client to pay ordinary income taxes on the basis of the company stock, but the remaining NUA will be taxed as long-term capital gain when the securities are sold. In contrast, if the entire balance is rolled over to an IRA, all withdrawals, including that which comes from the profit on the company stock, will be taxed at your client’s ordinary income tax rate.

Returning to an earlier employer

If your client may return to this employer, they may want to keep the plan where it is. This is especially true for government employers with section 457 plans, due to their ability to supply retirement income without penalty much earlier than an IRA or a 401(k) plan could. If they’ve withdrawn and closed their account and come back to work for the same agency, the old plan may no longer be available since they’re now considered a “new” participant. If your client is in this situation, keeping the existing plan gives them the choice to begin taking distributions prior to age 59½ without penalty. If these funds are moved over to an IRA, this possibility is lost.

Other 401(k) rollover rules to consider

ERISA protection

Funds in a 401(k) account are protected by ERISA (Employee Retirement Income Security Act of 1974) and are generally not available to creditors. IRA assets may be available to creditors in certain situations, depending on the balance of the IRA and applicable state laws.

After tax contributions

If your client has made after-tax contributions, as some plans allow, it makes sense to separate these contributions from the pre-taxed amounts. They can convert these contributions directly over to a Roth IRA in most cases with no tax consequence. Once they’ve removed the after-tax contributions and put them into a Roth IRA, they can then rollover the rest of their 401(k) to an IRA. If your client has a Roth 401(k), the IRS requires that any employer match of contributions be placed in a pre-tax account and treated like matching assets in a traditional plan.

To avoid taxes when rolling over a Roth plan that includes matching employer contributions, your client will need to request the transfer of their contributions and earnings to a Roth IRA and the employer’s matching contributions and earnings be transferred to a traditional IRA.

Indirect rollovers

Indirect rollovers, where your client requests a lump-sum distribution from their plan and then takes responsibility for completing the transfer, have significant tax consequences. The plan must withhold 20% to ensure that taxes will be paid if the rollover is not completed. 401(k) rollover rules require funds be deposited in an IRA within 60 days (about two months) to avoid taxes on pretax contributions and earnings and to avoid the potential of an added 10% tax penalty if your client is younger than 59½. With a direct rollover, the former employer sends 401(k) assets directly to the new employer’s plan or to an IRA. Your client never handles the money.

Establishing a relationship with retirement plan participants is essential in capturing 401(k) rollovers. You can be in immediate contact with a participant when there is a change in their work or personal life. If they’ve left an employer, knowing the 401(k) rollover rules can help them better understand what to do with a 401(k) they left behind. If not done properly, an attempted rollover may result in a large, unexpected income tax liability.

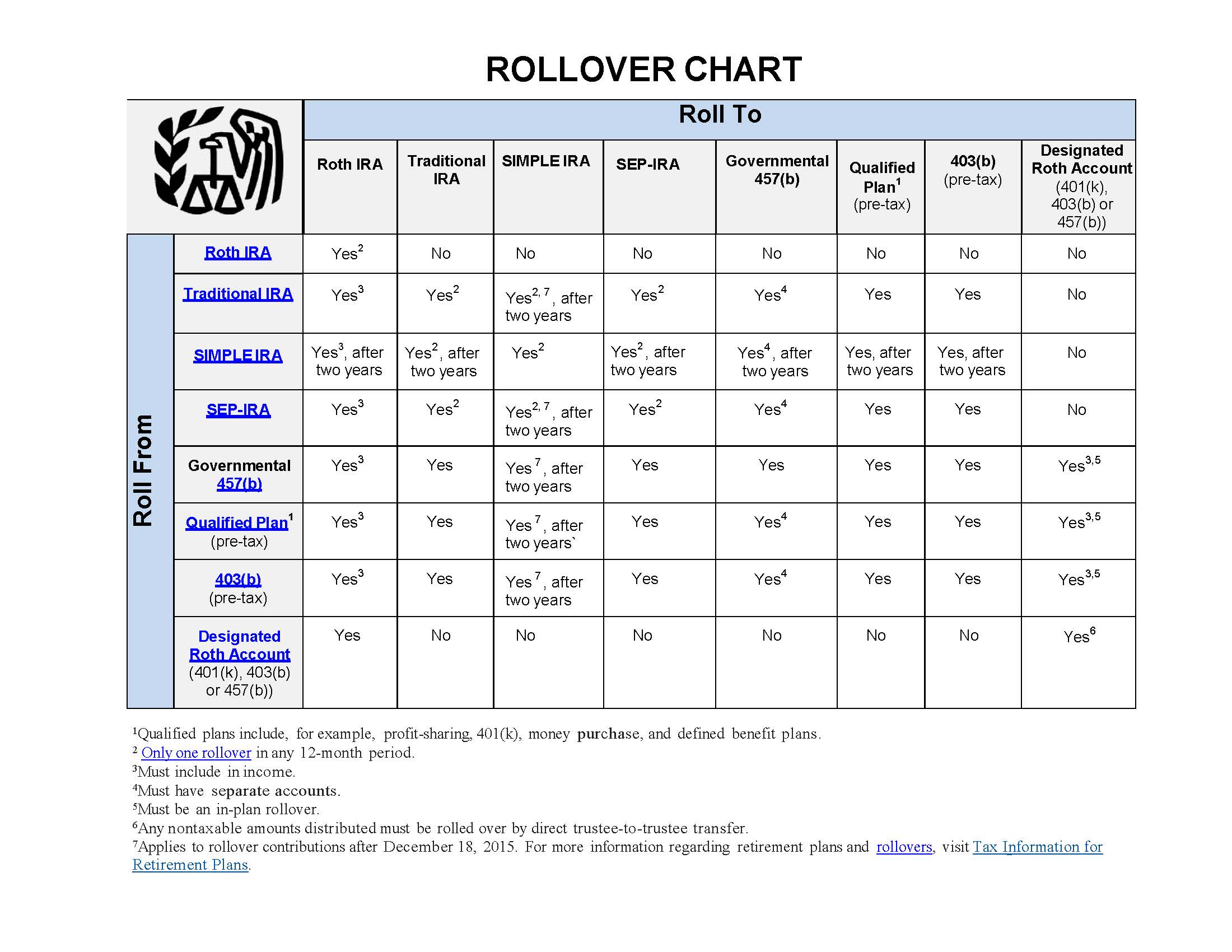

Many 401(k) rollover rules can vary depending on the type of account or other circumstances. This chart from the IRS summarizes allowable rollover transactions.

For more information about retirement plans and rollovers, check out this white paper brought to you by Advanced Underwriting Consultants and the Ameritas Advanced Solutions and Design Team.

Interested in representing Ameritas?

Discover the advantages we offer industry professionals of all kinds.