Harness the DI Insurance Potential of High-Income Clients

7 min read

7 min read

When it comes to financial risks, affluent white-collar professionals may appear well-protected. They typically have access to a strong benefits package, high earnings and a solid understanding of personal finance. But beneath the surface lies a critical vulnerability, one that often goes unnoticed until it’s too late: income protection.

For financial professionals, this market presents one of the most overlooked yet potentially rewarding opportunities in the disability income insurance space. Those in this market may not think they need additional coverage, but most are underinsured when it comes to protecting their income in the event of a disability.

Here’s why now is a good time to focus on this affluent segment and how you can become an essential resource in helping them protect their financial foundation.

1. High-income protection gaps

Group disability insurance through an employer often covers only a portion of salary—typically around 60% of base pay. It often excludes bonuses, commissions and equity-based compensation. For many professionals, those elements can make up a large share of their total income.

What happens if they can’t work due to sickness or injury? They may find that the benefit they counted on is only covering a fraction of their actual earnings. That income gap can have major consequences, delaying retirement, derailing college funding plans or forcing tough lifestyle decisions. Identifying and addressing this gap is a powerful way for financial professionals to add immediate value.

2. Greater need for supplemental coverage

This is where individual disability income insurance comes in. A well-designed DI policy can supplement group benefits and provide additional coverage to help bridge the income gap. It offers flexibility, stronger definitions of disability and a chance to help ensure clients can maintain their lifestyle and financial goals even if they’re unable to work.

Framing this conversation around continuity and control resonates. Professionals want to protect what they’ve built. Supplemental DI coverage helps them do just that.

3. Favorable underwriting for white collar professionals

One of the advantages of working with white-collar professionals is that they’re typically considered lower risk from an underwriting standpoint. As a result, they often qualify for:

- Higher monthly benefit limits.

- Own-occupation definitions of disability.

- Enhanced contract provisions and riders.

- More favorable premium rates.

This helps make the underwriting process smoother and makes it easier for you to place policies.

4. Strong ability to pay

Affluent professionals understand value. When presented with a clear case for protecting their income, they’re often more open to investing in comprehensive coverage, especially when the benefits are explained in the context of lifestyle preservation and long-term planning.

Affordability tends to be less of a barrier in this market. Instead, the conversation is about how the policy fits into their broader financial strategy.

5. Cross-selling and referral potential

One of the most powerful aspects of working with professionals is their tendency to refer other high-income individuals. These clients are often well-connected in their industries and social networks, making them a valuable source of referrals.

In addition, DI insurance frequently opens the door to broader conversations. Once a professional sees the value you bring in helping solve their income protection gap, they’re more likely to engage with you on other needs—life insurance, long-term care planning or business succession strategies. DI insurance should be a relationship starter, not just a transaction.

6. Certain industries are ideal entry points

Some industries stand out for their reliance on consistent, high-level income—and the gaps created by employer coverage limitations:

- Legal: Attorneys often have complex compensation structures with performance-based bonuses.

- Healthcare: Physicians and specialists rely on their ability to practice in a specific field, making own-occupation coverage essential.

- Finance: Bankers and advisors often have high incomes supplemented by commissions and bonuses.

- Technology: Professionals may receive stock options or equity that wouldn’t be factored into standard group DI benefits.

Targeting these niches allows you to tailor your approach and speak directly to the pain points in each profession.

Navigating common challenges

While this market offers strong potential, it does require a thoughtful, consultative approach. Consider these common hurdles—and how to address them:

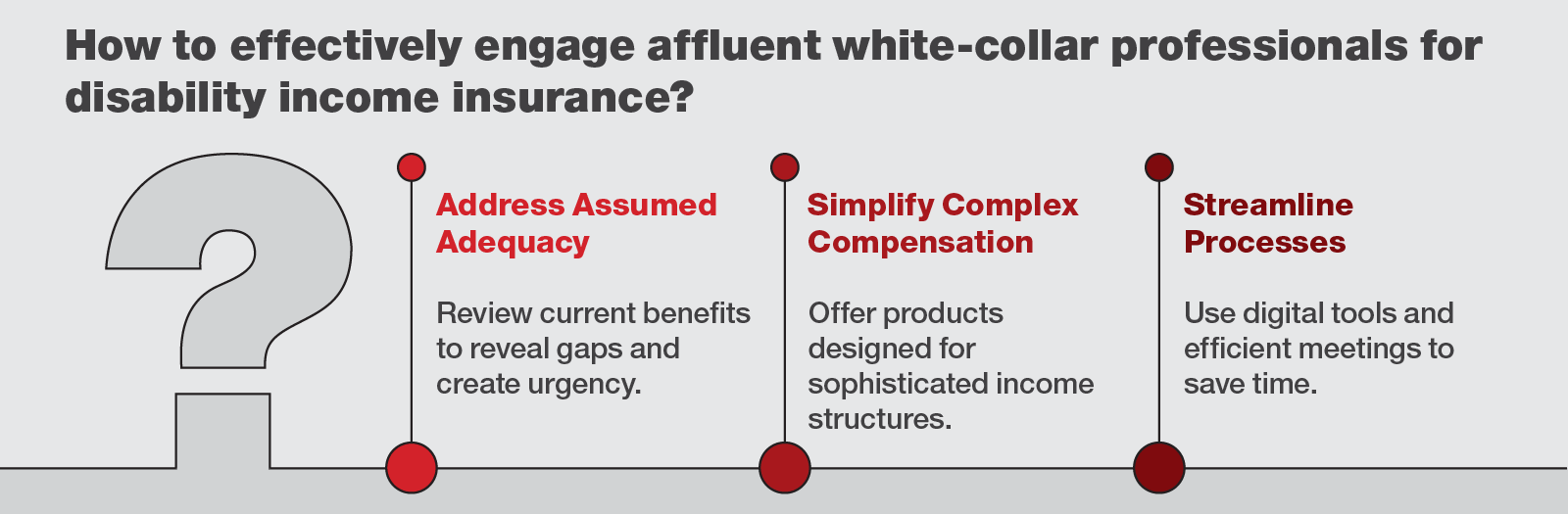

- Assumed adequacy: Many professionals mistakenly believe their employer coverage is sufficient. Start the conversation by offering to review their current benefits. A quick analysis can reveal significant gaps and create urgency.

- Complex compensation: Bonuses, equity and deferred comp add layers of complexity. Ameritas understands these nuances and offers products designed for sophisticated income structures.

- Limited time: These clients are busy. Focus on streamlined processes, efficient meetings and digital tools that make the experience as frictionless as possible.

A market that needs you—even if it doesn’t know it yet

Affluent professionals have the most to lose if their income disappears, yet many are unknowingly underinsured. This creates a meaningful opportunity for financial professionals who are willing to lead with education, ask the right questions and provide tailored strategies. Share this blog with your clients about the benefits of DI insurance to protect their earnings to start the conversation.

Ameritas is ranked as one of the best DI insurance companies1 and offers comprehensive and tailored DI insurance options. Learn more about our DI offerings. By specializing in income protection strategies for high-earning professionals, you’re not just adding a product to your practice, you’re carving out a valuable niche. One that strengthens client relationships and grows through word-of-mouth.

Disability Income Insurance policies are issued by Ameritas Life Insurance Corp. and Ameritas Life Insurance Corp. of New York.

Sources and References:

1Good Financial Cents

Interested in representing Ameritas?

Discover the advantages we offer industry professionals of all kinds.