3 Key Retirement Strategies Beyond Start Saving Young

8 min read

8 min read

Planning for retirement is one of the most important steps you can take to achieve long-term financial independence and security. As you consider your financial future, questions like, “What are the best ways to save for retirement?” and “How much should I save for retirement?” are fundamental to building a strong financial foundation.

The growth potential of your retirement savings hinges on your contributions, the duration of your savings, the investment options you select and starting to save young. While growth is not guaranteed, understanding these factors can help you make informed decisions to maximize your retirement savings.

Here are four key strategies to consider.

1. Take advantage of employer-sponsored retirement plans

If your employer offers a retirement plan, such as a 401(k), take advantage of it. These plans allow you to save for retirement with pre-tax dollars, which can reduce your taxable income and increase your take-home pay. Additionally, many employers offer a matching contribution, which is essentially free money.

When you contribute to a 401(k) or other employer-sponsored retirement plan, your money is invested in a variety of funds, such as stocks, bonds and mutual funds. Over time, the value of these investments have the potential to grow, helping provide you with a nest egg for retirement.

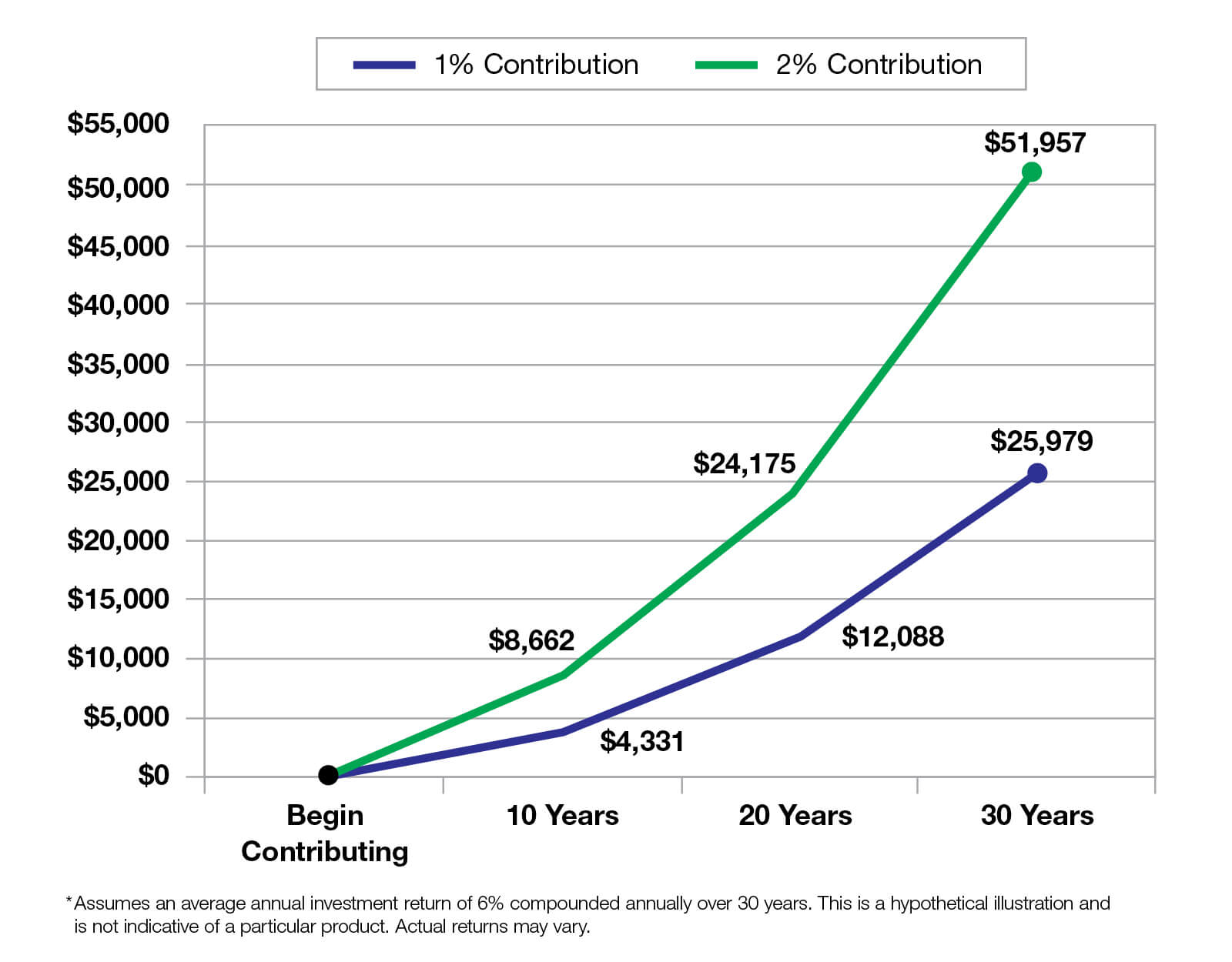

How much should you contribute? While every investor’s situation is different, it pays to know how much just a 1% difference can make. Let’s say you earn $31,000 a year. If you contribute just 1% of your gross earnings to your 401(k), that’s about $6 per week—about the cost of a fancy coffee. After one year, you increase your contribution by just 1%, increasing your contribution to $12 per week, about the cost of a burger.

This chart shows what a difference a simple 1% increase in contribution can make over the years.

These frequently asked questions about 401(k) Retirement Plans can help you during your savings journey.

2. Diversify your retirement investments

Diversification* is a cornerstone of successful retirement planning. By spreading your investments across various asset classes—such as stocks, bonds, real estate and mutual funds—you can potentially mitigate risks associated with market volatility and enhance the stability of your portfolio. Furthermore, consider including both traditional and Roth retirement accounts in your strategy to maximize tax advantages.

Regularly reviewing and rebalancing your portfolio to ensure it remains diversified is crucial to maintaining your desired risk level and ensuring that your investment mix aligns with your financial goals. This proactive approach allows you to adapt to changing market conditions and capitalize on growth opportunities.

3. Automate your savings and contribute regularly

One of the simplest yet most effective strategies to bolster your retirement plan is to automate your savings. By establishing automatic transfers from your checking account to your savings or retirement account, you can make saving a seamless part of your financial routine. This ensures that you consistently contribute to your retirement fund without the temptation to spend the money elsewhere.

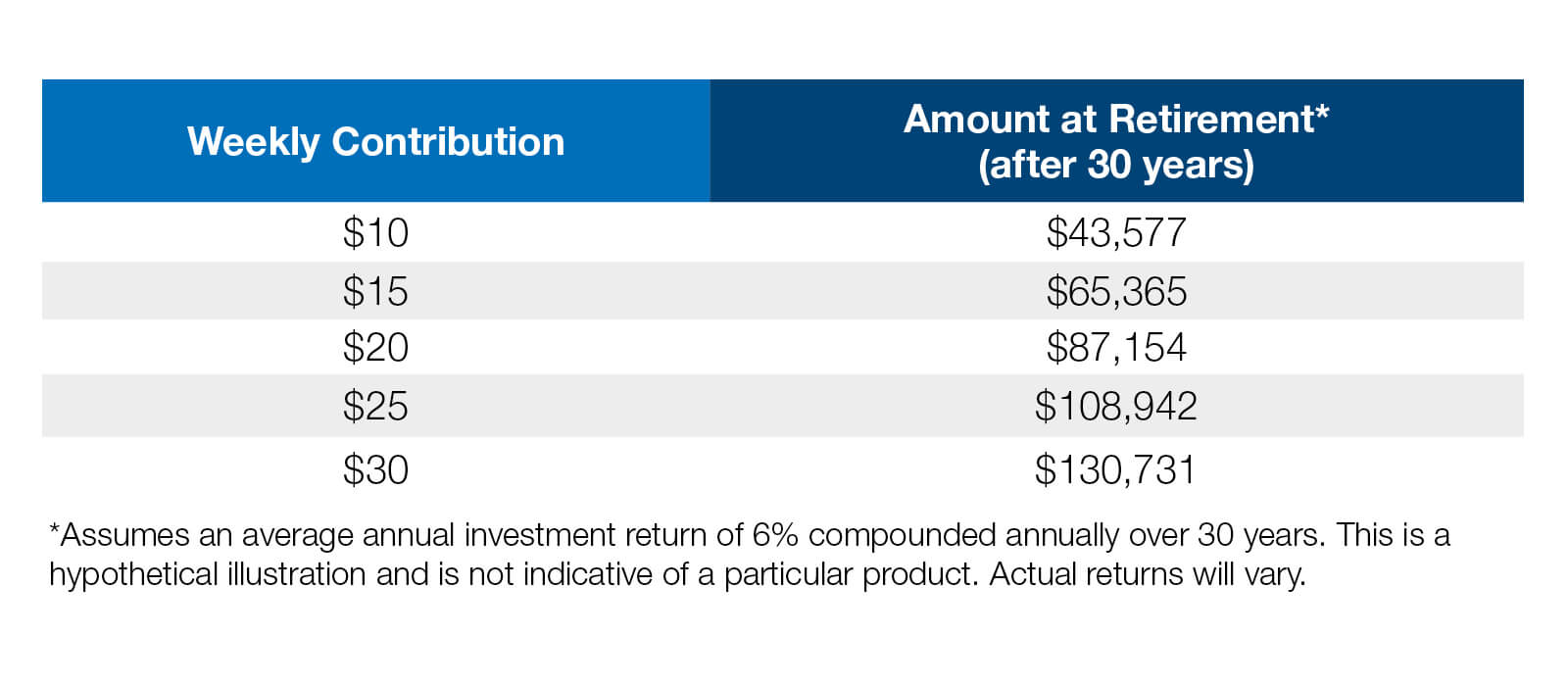

Automating your contributions also allows you to take full advantage of compound interest. Your savings will begin growing immediately, compounding over time for maximum impact. This table shows the retirement nest egg you could have after 30 years with the following weekly contribution amount and compound interest.

Incorporating regular contributions, whether through employer-sponsored plans or personal savings accounts, reinforces the habit of saving and can lead to significant growth potential in your retirement savings over time.

4. And, of course: Start saving young

Make no mistake, one of the most effective retirement investment strategies you can adopt is to begin saving early. The sooner you start contributing to your retirement accounts, the more time your investments have to flourish. Delaying your savings means you’ll have to contribute substantially more later to catch up. Use this calculator to see the difference starting early can make.

Finding extra money to save can feel overwhelming, particularly when you’re young. However, it’s essential to view saving as a non-negotiable expense in your budget. By prioritizing saving and establishing it as a habit, you’ll set yourself on the path to success. Instead of waiting to save what remains after spending—often nothing—consider savings as essential as rent. Set aside a specific amount each month (or week) to build your savings. Even modest contributions can lead to significant growth over time.

Remember, starting early means your money works for you longer, harnessing the benefits of compounding. Compounding happens when the returns on your investments are reinvested, generating additional earnings. Each year’s growth can build on the previous years, significantly enhancing your investment’s growth potential.

Here’s a hypothetical illustration of why early saving is crucial:

At age 25, Suzanne decides to save $150 each month for her retirement. After 15 years, she stops making contributions but allows her savings to remain untouched for an additional 25 years. Assuming a 6% average annual return, by the time she reaches 65, Suzanne will have accumulated $194,775, while her total contributions amount to only $27,000.

Conversely, just as Suzanne ceases her contributions, Henry starts saving. He saves $150 per month for the next 25 years. With the same 6% average annual return, by age 65, he will have contributed a total of $45,000, but his account will only have $90,826—$90,826 less than Suzanne’s total.1

Interested in learning more?

Ameritas can help. For retirement savings tips or for help planning for your financial future, speak with a financial professional.

1 This is a hypothetical example used for illustrative purposes only. It is not representative of any particular investment vehicle. It assumes a 6% average annual total return compounded monthly. Your investment results will be different. Tax-deferred amounts accumulated in the plan are taxable on withdrawal, unless they represent qualified Roth distributions.

*Diversification does not guarantee a profit or protect against loss. It is simply a method used to help manage risk.

Representatives of Ameritas do not provide tax or legal advice. Please consult your tax advisor or attorney regarding your specific situation.

Ready to take the next step toward your financial goals?

Our website offers helpful information about our products and services, but nothing beats personalized guidance. If you're serious about improving your financial wellness, connect with a financial professional today.