Economic downturns and volatile markets can make people nervous. Recognizing these events as a normal, although undesirable, part of the economic and investment cycles can help make these moments manageable. Here are some tips for surviving market turbulence during unpredictable times.

Just getting started with investments? Read our blog, 4 Steps to Start Investing: A Beginner’s Guide.

Tips to stay in the market

Don’t panic. Some people may be tempted to bail out of their stock investments if markets are having a particularly rough ride. Selling solely because the stock market tumbles may be the worst thing to do.

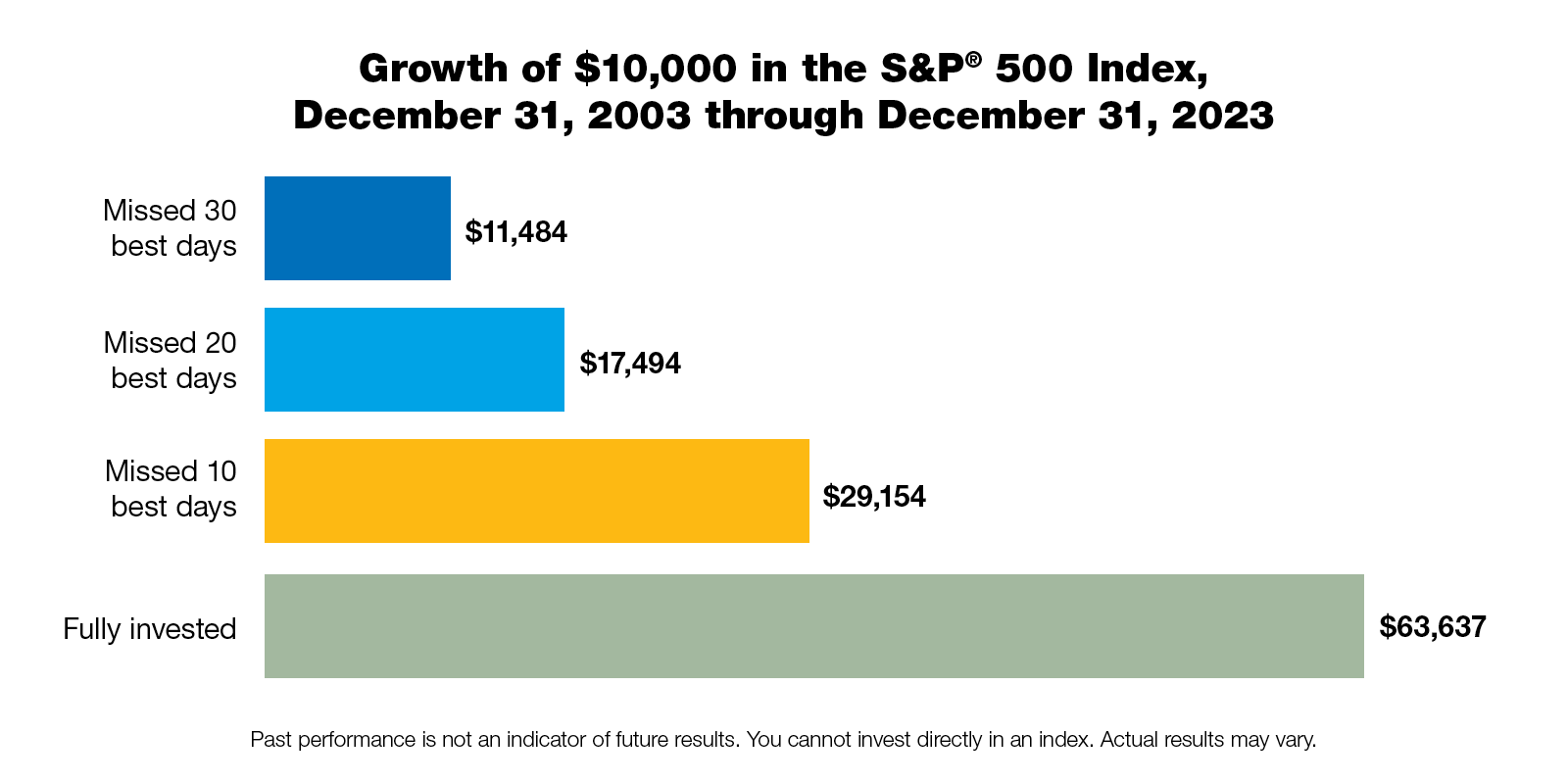

Stay invested. The chart below shows that pulling money out of the market — even for just a few weeks — could really cost you in potential investment gains. If missing the 10 best days sounds implausible to you, consider that in the past 20 years, seven of those best days happened within just about two weeks of the 10 worst days.

If the stock market posted gains and losses every other year, imagine what you would lose by selling after a dip. Where would you put your money? A money market account might earn a steady 1.3%, but that won’t even keep up with the average long-term inflation rate of 2.15%.

Tips to think about the future

Keep a long-term perspective. It’s easiest to stay the course if you focus on your major life goals and not on the market’s day-to-day or month-to-month movements. Look at your quarterly account statements and stay on top of major current financial events. Plan to do a thorough review of your investments — asset allocation, investment performance and progress towards your goals — once a year. For more ideas, check out our financial review checklist.

Dollar cost average. One of the most effective approaches to investing is dollar cost averaging. You simply commit to investing the same dollar amount on a regular basis. When the price of shares in a stock or investment portfolio rises, you’ll buy fewer shares, and when the price dips, you’ll buy more.1

Maintain a diversified portfolio. Diversification lowers your risk because historically not all parts of the market move in the same direction at the same time. Losses in one area may be balanced out by gains elsewhere.2

Know your risk tolerance. If you find stock investments to be too risky for your taste — for example, if you can’t sleep at night because you’re worrying about your stocks — maybe you should consider a safer, steadier ride.

Make thoughtful moves. If you make changes to your investments, do so in a thoughtful way, and after careful consideration. Talking with a financial professional could be a good first move.

Talk with a financial professional

If you’re thinking about making a change to your investments, consider talking with your financial professional. If you don’t have a financial professional, we can help you find one here. They can help you develop a savings plan, including how you’ll manage volatile markets. Sticking to your plan and maintaining a consistent strategy during both good and bad times can help you reach your goals for a fulling financial future.

Need help with your financial goals?

While you can learn more about our products on this website, this information is no substitute for the guidance of a qualified professional. If you’re serious about assessing your financial wellness, contact a financial professional.

Do you already have an agent?