Using Annuities and Life Insurance for Retirement Planning

8 min read

8 min read

Ernst & Young’s study provides a rigorous, data-driven validation of integrated retirement planning

As a financial professional, you’re continually seeking ways to optimize retirement income strategies in the face of increasing longevity, market volatility and evolving client expectations. A recent study by Ernst & Young, Benefits of Integrating Insurance Products into a Retirement Plan (2025), offers compelling evidence that incorporating insurance-based strategies, specifically indexed annuities (IA) and indexed universal life (IUL) insurance, into retirement portfolios can potentially enhance client outcomes.

Learn more about Ameritas index annuities

Learn more about Ameritas indexed life insurance

Study design and methodology

The analysis employed Monte Carlo simulations across 1,000 market scenarios, incorporating randomized inputs for interest rates, inflation, equity returns and bond yields. The study evaluated six retirement strategies across three investor starting ages (35, 45 and 65):

- Investment-only

- IUL and investments

- IA and investments

- Single Premium Immediate Annuity (SPIA) and investments (age 65 only)

- Integrated strategy: IUL, IA and investments

- IUL, SPIA and investments (age 65 only)

Each strategy was assessed based on two key metrics:

- After-tax retirement income sustainable in 90% of scenarios.

- Legacy value at the end of the time horizon, net of taxes.

Key technical findings

1. IUL and IA outperform fixed income.

Both IUL and IA consistently outperformed fixed income allocations over the long term. This is attributed to:

- IUL: Cash value accumulation, downside protection and tax-advantaged access through policy loans during market downturns1.

- IA: Enhanced income through index-linked growth, guaranteed2 lifetime withdrawal benefits and principal protection.

2. Integrated strategies yield stronger outcomes.

For a 65-year-old couple allocating 30% of their initial retirement wealth to IUL and 30% to an IA:

- Retirement income increased by 5.5%.

- Legacy value increased by 29.6% compared to investment-only strategies.

These results demonstrate that even at retirement age, integrated strategies can enhance both income and legacy outcomes, especially when combining insurance products with traditional investments. Similar benefits were observed across younger age groups as well, with increased allocations to insurance products yielding stronger financial outcomes over time.

3. Asset allocation efficiency

In integrated strategies, insurance products were treated as part of the fixed income allocation. This allowed for a reduction in bond exposure while maintaining or improving portfolio stability. Allocation combinations were tested in 10% increments, with caps at 60% for IUL and 30% for IA.

4. Tax optimization

IUL and IA offer tax advantages:

- IUL: Tax-deferred growth, typically tax-free death benefit and tax-advantaged access via policy loans1 (assuming non-MEC status).

- IA: Tax-deferred accumulation and predictable income taxed at ordinary rates upon distribution3.

These features can help contribute to higher net retirement income and legacy values, especially when withdrawals from qualified assets are minimized.

5. Market volatility buffering

The cash value of an IUL policy can serve as a liquidity buffer during market downturns. By accessing policy loans instead of selling equities at a loss, clients can help preserve portfolio value and reduce sequence-of-returns risk. This dynamic can help improve long-term outcomes and can support equity allocations elsewhere in the portfolio.

6. Customization based on client priorities

Ernst & Young’s modeling shows that:

- Higher IA allocations favor income maximization.

- Higher IUL allocations favor legacy preservation.

- Balanced allocations (e.g., 30% IUL + 30% IA) optimize both outcomes.

This flexibility allows advisors to tailor strategies based on client goals, risk tolerance and time horizon.

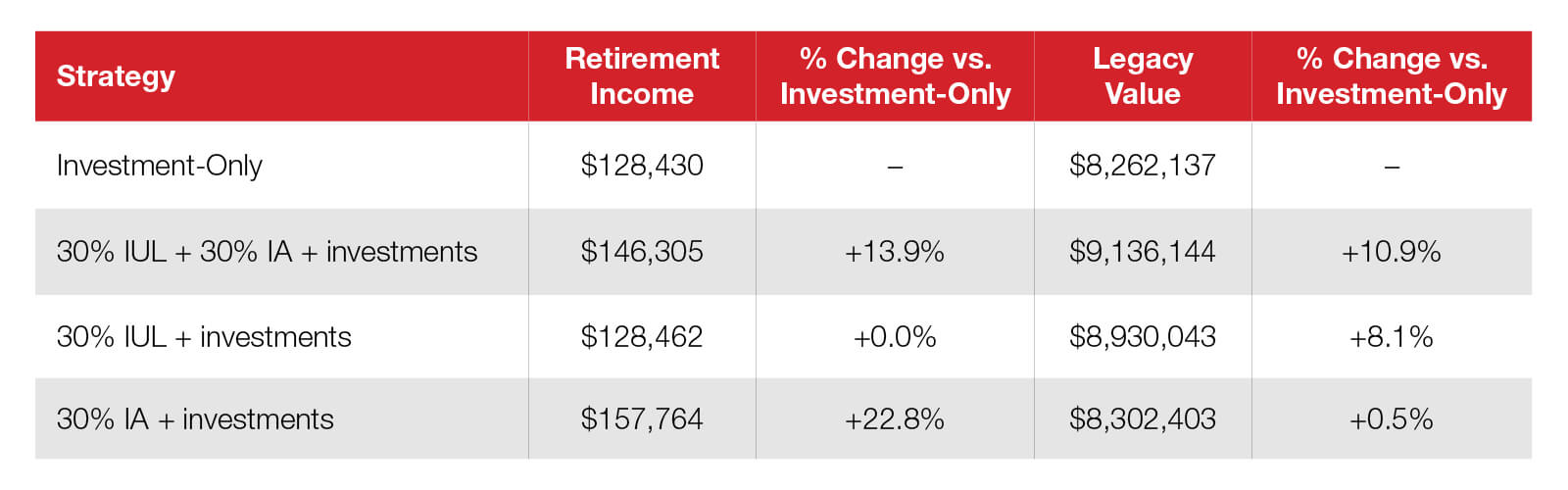

Comparative performance metrics

These results demonstrate that while deferred income annuity-only strategies may yield higher income, integrated strategies offer a more balanced improvement across both income and legacy metrics and do so consistently across all age groups.

Implementation considerations

- Product selection: Financial professionals must evaluate IA and SPIA features such as guaranteed lifetime withdrawal benefits, inflation protection and payout options. For IUL, policy structure, index crediting methods and loan provisions are critical.

- Tax planning: Ensure IUL policies are not MECs to preserve tax advantages. Coordinate annuity distributions with other income sources to manage tax brackets.

- Liquidity needs: While IAs and SPIAs offer guaranteed income, they reduce liquidity. IUL can offset this by providing accessible cash value.

- Client suitability: Younger clients benefit from long-term compounding in IUL; older clients may prioritize income from an IA or SPIA.

Why Ameritas?

Ameritas offers competitive products that align closely with the integrated retirement planning strategies validated by Ernst & Young’s 2025 study.

Ameritas index annuities offer flexible lifetime income options, including guaranteed lifetime withdrawal benefits and inflation-sensitive roll-up rates; market-linked growth potential and principal protection.

Ameritas IUL policies provide structured flexibility, multiple index crediting strategies, and both fixed and variable loan provisions to support long-term cash value growth.

Compass SPIA delivers immediate, guaranteed income for life or a set period with predictable payouts.

In addition, Ameritas supports financial professionals in implementing integrated retirement planning strategies through a robust network of specialized teams designed to enhance your success.

- The Advanced Planning team provides guidance on complex planning scenarios, leveraging sophisticated financial tools to help you present and implement strategies.

- The Sales Development and Distribution teams offer tailored training, marketing resources and case design support to help you confidently present and implement insurance-based strategies.

- The Internal Sales Desk delivers real-time product expertise and illustration support, ensuring you can model scenarios aligned with client goals.

These collaborative teams empower financial professionals to deliver personalized, outcome-driven retirement strategies by combining Ameritas’ product strengths with strategic planning insights, ultimately helping clients achieve greater income security, legacy value and portfolio resilience.

A framework for the future of retirement planning

Ernst & Young’s study provides a rigorous, data-driven validation of integrated retirement planning. The implications are clear: combining fixed indexed annuities and indexed universal life with traditional investments can help enhance portfolio efficiency, improve client outcomes and offer a more resilient framework for retirement income planning.

This approach is not a replacement for traditional investments, but a strategic enhancement. By leveraging the unique strengths of insurance products – guaranteed income, tax efficiency and market buffering – you can deliver more personalized, outcome-driven retirement strategies.

1Loans and withdrawals will reduce the life insurance policy’s death benefit and available cash value. Excessive loans or withdrawals may cause the policy to lapse. Unpaid loans are treated as a distribution for tax purposes and may result in taxable income.

2 Guarantees are based on the claims-paying ability of the issuing company.

3 Withdrawals of annuity policy earnings are taxable and, if taken prior to age 59 ½, a 10% penalty tax may also apply.

Representatives of Ameritas do not provide tax or legal advice. Please refer clients to their tax advisor or attorney regarding their specific situation.

In approved states, Ameritas indexed universal life insurance products are issued by Ameritas Life Insurance Corp. In New York, life insurance is issued by Ameritas Life Insurance Corp. of New York.

In approved states, Ameritas annuities are issued by Ameritas Life Insurance Corp.

Interested in representing Ameritas?

Discover the advantages we offer industry professionals of all kinds.