What’s the Difference Between MEPs and PEPs?

6 min read

6 min read

Now more than ever, small- and medium-sized businesses are actively exploring the idea of offering retirement plans to their employees. Well-managed, competitive 401(k) programs can help businesses attract and retain top talent, secure potentially significant tax breaks and deductions and satisfy current or impending state retirement plan mandates with maximum flexibility. Even better, recent legislation has made the process of setting up and managing a 401(k) program dramatically easier for businesses—putting the benefits of a retirement plan in reach.

“One major barrier that has kept business owners from sponsoring a retirement plan is the amount of administration required,” explains Scott Holechek, Ameritas institutional sales leader and pooled retirement plan thought leader. “Business owners are busy running and growing their business and often do not have the time or expertise to manage the day-to-day administration of a 401(k) plan. Now, with pooled retirement plans, especially MEPS and PEPs, the responsibility for running the 401(k) plan drops down to less than 5% of the usual tasks to administer the plan—and only a few hours a year.”

The retirement plan marketplace has undergone a rapid and business-friendly evolution in the past few years. Ameritas has been at the forefront of this shift, first in working with financial professionals to bring multiple employer plans to their clients, and now leading the industry in pooled employer plans.

MEPs gain momentum

Multiple Employer Plans (MEPS) have been available for many years. MEPs are sponsored by a third party, known as the MEP Sponsor. That sponsor, typically an association or professional employer organization (PEO), takes on the responsibility and liability for running the plan.

MEPs are ideal for businesses for many reasons—they’re easy for a business to administer, they’re compliant with DOL and IRS regulations, they’re competitive and they’re affiliated with well-established partners and administrators. Their key requirement, however, is that all employers participating in the MEP have a common nexus of interest. For example, businesses within the same industry (food service, construction, etc.), geographic area or who are affiliated through an association or PEO can join a MEP that allows them to design a plan with unique benefits for their employees.

Employers, however, have often been wary of the “one bad apple rule” that could jeopardize the entire MEP. Under this rule, the entire MEP could be disqualified based on the actions of only one employer that participated in the plan. One major change in the MEP marketplace occurred with the enactment of the Setting Every Community Up for Retirement Enhancement (SECURE) Act in 2019, often referred to as SECURE 1.0. This act provided significant relief to the “one bad apple rule” and renewed interest in multiple employer plans.

PEPs expand access

SECURE 1.0 also created a new type of pooled plan—the Pooled Employer Plan (PEP). Through a PEP, unrelated employers can participate in a pooled retirement plan without having to meet the common nexus requirement that had been the standard for multiple employer plans.

PEPs offer several of the same benefits as MEPs. In addition, they are even easier for businesses to participate in because a separate pooled plan provider takes on the primary administration and fiduciary responsibility for the overall PEP, including oversight of the plan administration, compliance and investments. They also minimize fiduciary liability, since the PPP manages all entities associated with the PEP. With nearly 95% of administrative and fiduciary tasks outsourced, participating employers can reassign their people to tasks more directly related to their business.

Perhaps most importantly, PEPs allow businesses of all sizes to pool their resources to ensure their employees have access to a competitive, well-run 401(k) plan. PEPs, such as the Ameritas PEP, can be customized in many ways to meet the company’s needs. They offer flexibility with items like eligibility and enrollment, employer contribution formulas, safe harbor allocations, vesting schedules and more.

“Small business owners today need a plan that’s easy to administer, that minimizes fiduciary liability and is fully compliant, and that frees up internal resources,” explains Nicholas Betlow, business development manager. “At Ameritas, we can offer all these benefits within a well-regarded, cost-competitive 401(k) that offers real value to plan participants.”

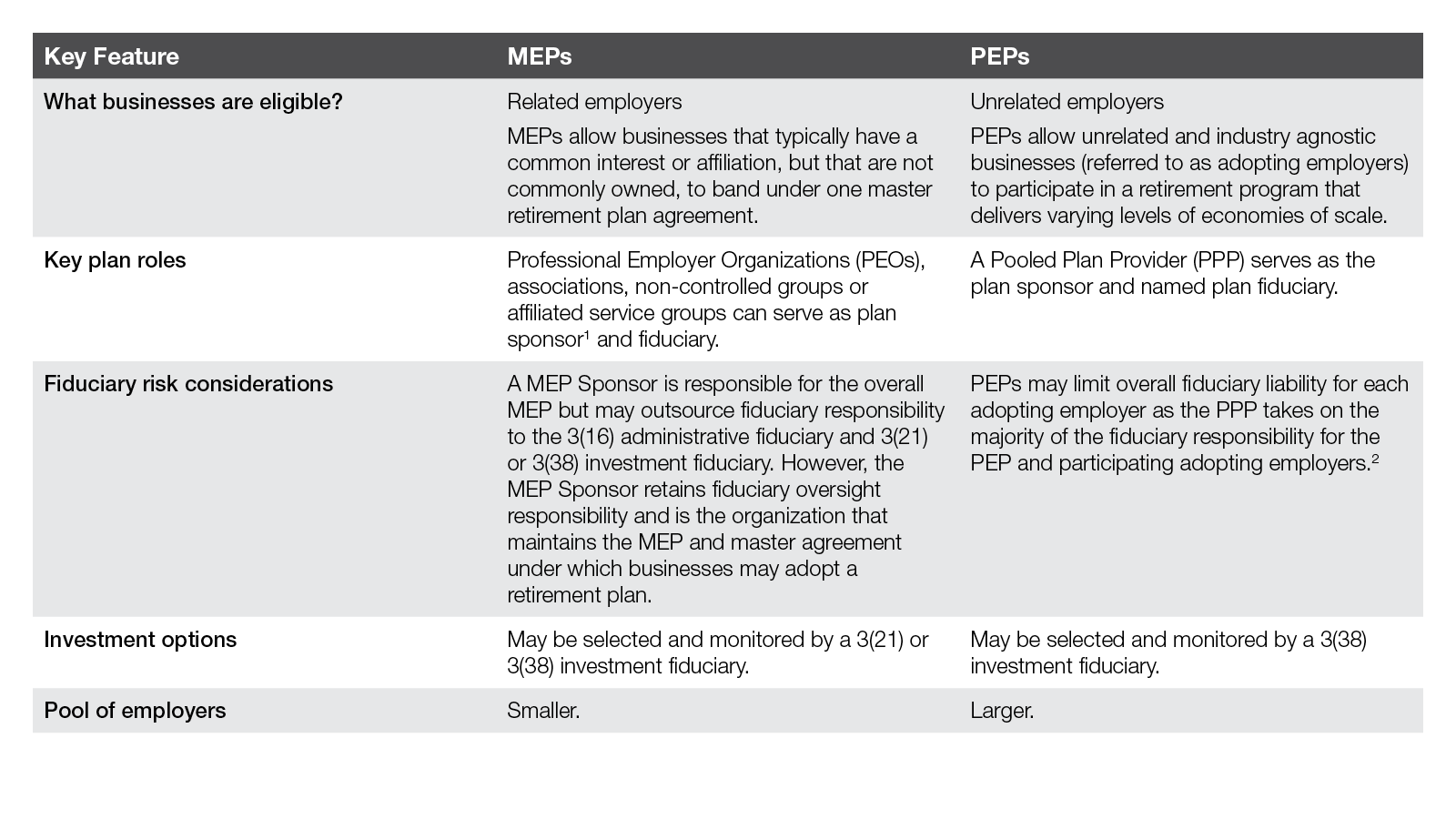

Quick overview: What’s the difference between MEPs and PEPS?

What does it mean to PEP your MEP?

If your clients already have a multiple employer plan that they’re interested in expanding to a broader group of employers, they have the option to “PEP their MEP,” or convert their plan to this newer retirement plan type. PEPs may be a more attractive option for associations or PEOs as this plan type expands the universe of potential employers that can join the PEP. A pooled plan provider can help a business convert their MEP to a PEP, while complying with all applicable laws.

Getting started

At Ameritas, we’ve been a leader in the retirement plan marketplace for over 60 years, servicing more than 8,500 plans and 269,000 participants (as of January 1, 2023). As a result, we have the expertise, personnel and experience to help you—and your clients—succeed in the marketplace.

“With a full suite of retirement plan options and deep experience in the market, we can help you provide your clients with a retirement plan solution that’s right for them,” explains Holechek. “Whether you choose to participate in a MEP or a PEP, that plan will help your clients minimize their fiduciary responsibility and be easy to administer, cost competitive and fully compliant.”

We look forward to providing you our best-in-class service and solutions as you expand your practice with MEPs and PEPs. Connect with us today to learn more.

Sources and References:

1 May include management service organization (MSO) if they qualify as a PEO. Administrative Services Only (ASO) groups cannot be part of an Association MEP.

2 All retirement plans involve some level of fiduciary responsibility for the plan sponsor and adopting employers. Employers are encouraged to consult with their retirement plan professional for an assessment.

Interested in representing Ameritas?

Discover the advantages we offer industry professionals of all kinds.